Rising Electric Vehicle Adoption

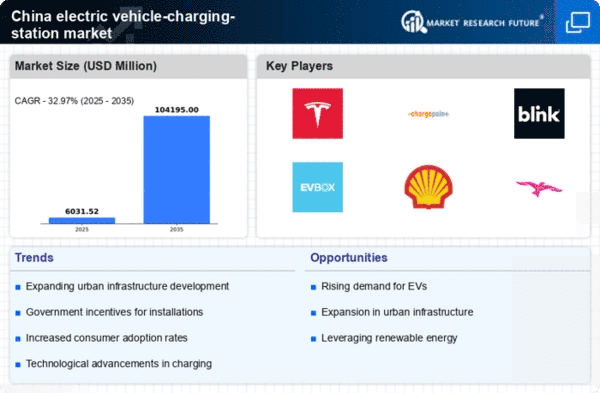

The increasing adoption of electric vehicles (EVs) in China is a primary driver for the electric vehicle-charging-station market. As of 2025, the number of EVs on the road is projected to surpass 10 million units, reflecting a growth rate of approximately 30% annually. This surge in EV ownership necessitates a corresponding expansion in charging infrastructure. The government has set ambitious targets to have 20% of all new vehicle sales be electric by 2025, further stimulating demand for charging stations. Consequently, the electric vehicle-charging-station market is likely to experience significant growth as consumers seek convenient and accessible charging solutions to support their EV usage.

Government Incentives and Subsidies

Government incentives and subsidies play a crucial role in shaping the electric vehicle-charging-station market in China. The Chinese government has allocated over $10 billion in subsidies to promote the development of EV infrastructure, including charging stations. These financial incentives encourage private companies to invest in charging networks, thereby enhancing the availability of charging options for consumers. Additionally, local governments are implementing policies that provide tax breaks and grants for the installation of charging stations. This supportive regulatory environment is expected to accelerate the growth of the electric vehicle-charging-station market, making it more attractive for investors and operators alike.

Urbanization and Infrastructure Development

Rapid urbanization in China is driving the demand for electric vehicle-charging stations. As cities expand and populations increase, the need for efficient transportation solutions becomes more pressing. Urban areas are witnessing a rise in EV usage, leading to a greater requirement for accessible charging infrastructure. The electric vehicle-charging-station market is likely to benefit from ongoing urban development projects, which often include plans for integrating charging stations into new residential and commercial developments. Furthermore, the government has committed to enhancing urban infrastructure, which may include the installation of thousands of new charging points in metropolitan areas, thereby supporting the growth of the market.

Technological Innovations in Charging Solutions

Technological innovations are significantly influencing the electric vehicle-charging-station market in China. Advancements in charging technology, such as ultra-fast charging and wireless charging solutions, are enhancing the user experience and reducing charging times. As of 2025, the market is witnessing the introduction of charging stations capable of delivering up to 350 kW, allowing EVs to charge in under 15 minutes. These innovations not only improve convenience for consumers but also encourage more individuals to transition to electric vehicles. The electric vehicle-charging-station market is expected to expand as these cutting-edge technologies become more widely adopted, making charging more efficient and accessible.

Environmental Awareness and Sustainability Goals

Growing environmental awareness among consumers and businesses is driving the electric vehicle-charging-station market in China. As the nation aims to reduce carbon emissions and combat climate change, there is an increasing emphasis on sustainable transportation solutions. The government has set a target to achieve carbon neutrality by 2060, which includes promoting the use of electric vehicles and the necessary charging infrastructure. This commitment to sustainability is likely to foster a favorable environment for the electric vehicle-charging-station market, as more stakeholders recognize the importance of investing in green technologies and infrastructure to meet environmental goals.

.png)