Growing Cyber Threat Landscape

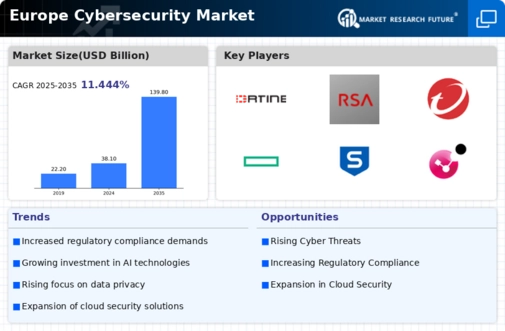

The Europe Cyber Security Market is currently experiencing a surge in demand due to an increasingly complex cyber threat landscape. Cyberattacks, including ransomware and phishing, have escalated, prompting organizations to bolster their security measures. In 2025, it was reported that cybercrime costs in Europe reached approximately 200 billion euros, highlighting the urgent need for robust cybersecurity solutions. As businesses and governments recognize the potential financial and reputational damage from breaches, investments in cybersecurity technologies and services are expected to rise significantly. This trend indicates a strong market driver, as organizations seek to protect sensitive data and maintain compliance with stringent regulations.

Emergence of Advanced Technologies

The integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is transforming the Europe Cyber Security Market. These technologies enable organizations to detect and respond to threats more efficiently, thereby enhancing overall security. As of January 2026, it is estimated that AI-driven cybersecurity solutions will account for a significant portion of the market, with growth rates projected to exceed 20% annually. This technological advancement not only improves threat detection capabilities but also automates responses to incidents, reducing the burden on security teams. Consequently, the adoption of advanced technologies is expected to be a key driver of market growth in Europe.

Increased Adoption of Cloud Services

The shift towards cloud computing has emerged as a pivotal driver in the Europe Cyber Security Market. As organizations migrate their operations to the cloud, the need for enhanced security measures becomes paramount. According to recent data, approximately 70% of European businesses have adopted cloud services, creating a pressing demand for cloud security solutions. This trend is further fueled by the rise of remote work, which necessitates secure access to cloud-based applications. Consequently, cybersecurity providers are innovating to offer tailored solutions that address the unique challenges associated with cloud environments, thereby driving market expansion.

Regulatory Frameworks and Compliance

The Europe Cyber Security Market is heavily influenced by stringent regulatory frameworks aimed at enhancing data protection and cybersecurity. The General Data Protection Regulation (GDPR) and the Network and Information Systems (NIS) Directive have established rigorous compliance requirements for organizations operating within the region. As of January 2026, non-compliance can result in hefty fines, which may reach up to 4% of annual global turnover. This regulatory environment compels businesses to invest in cybersecurity measures to avoid penalties and safeguard customer data. Consequently, the demand for compliance-driven cybersecurity solutions is likely to propel market growth in Europe.

Investment in Cybersecurity Skills and Workforce

The Europe Cyber Security Market is witnessing a growing emphasis on developing a skilled cybersecurity workforce. As cyber threats evolve, the demand for qualified professionals in the field has surged. Reports indicate that Europe faces a shortage of over 300,000 cybersecurity experts, which poses a significant challenge for organizations striving to enhance their security posture. In response, governments and educational institutions are increasingly investing in training programs and initiatives to cultivate cybersecurity talent. This focus on workforce development is likely to stimulate market growth, as organizations seek to bridge the skills gap and ensure effective cybersecurity measures are in place.