Germany : Robust Growth Driven by Innovation

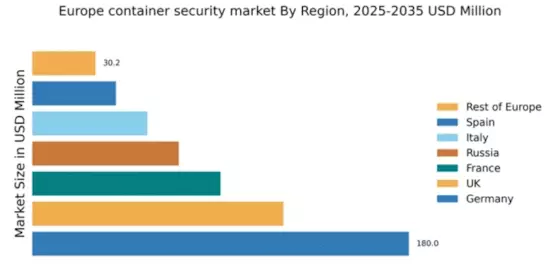

Germany holds a dominant position in the European container security market, valued at $180.0 million, representing approximately 30% of the total market share. Key growth drivers include a strong emphasis on cybersecurity regulations, particularly the IT Security Act, which mandates enhanced security measures for critical infrastructure. The demand for container security solutions is bolstered by the rapid adoption of cloud-native technologies and microservices, alongside significant investments in digital transformation across industries.

UK : Innovation and Regulation Fuel Growth

The UK container security market is valued at $120.0 million, accounting for about 20% of the European market. Growth is driven by increasing cyber threats and the implementation of the National Cyber Security Strategy, which emphasizes the need for robust security solutions. The demand for container security is particularly strong in sectors like finance and healthcare, where data protection is paramount. The UK government also supports innovation through funding initiatives for cybersecurity startups.

France : Regulatory Support and Market Growth

France's container security market is valued at $90.0 million, representing roughly 15% of the European market. The growth is fueled by the French Digital Security Strategy, which promotes the adoption of advanced security technologies. Demand is rising in sectors such as telecommunications and e-commerce, where the need for secure container environments is critical. The French government is also investing in infrastructure to support digital transformation, enhancing the overall market landscape.

Russia : Regulatory Landscape Influences Growth

Russia's container security market is valued at $70.0 million, making up about 11% of the European market. Key growth drivers include the increasing focus on national cybersecurity initiatives and the implementation of the Federal Law on Personal Data. Demand is particularly strong in the energy and telecommunications sectors, where security is vital. However, geopolitical tensions and regulatory challenges may impact foreign investments and market dynamics.

Italy : Investment in Digital Infrastructure

Italy's container security market is valued at $55.0 million, representing approximately 9% of the European market. Growth is driven by the Italian National Cybersecurity Strategy, which aims to enhance the security of digital infrastructures. The demand for container security solutions is increasing in sectors like manufacturing and logistics, where operational efficiency and data protection are crucial. Local investments in technology and infrastructure are further supporting market expansion.

Spain : Focus on Cyber Resilience

Spain's container security market is valued at $40.0 million, accounting for about 7% of the European market. The growth is driven by the Spanish Cybersecurity Strategy, which emphasizes the importance of securing digital assets. Demand is particularly strong in the tourism and finance sectors, where data security is critical. The Spanish government is also promoting public-private partnerships to enhance cybersecurity capabilities, fostering a more resilient market environment.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe container security market is valued at $30.21 million, representing about 5% of the total market. Growth drivers vary significantly across countries, influenced by local regulations and market maturity. Demand trends show a rising interest in container security solutions, particularly in Eastern European nations where digital transformation is accelerating. The competitive landscape includes both local and international players, adapting to diverse market needs and regulatory environments.