Escalating Cybersecurity Threats

The Container And Kubernetes Security Market is significantly influenced by the escalating cybersecurity threats faced by organizations. With the increasing sophistication of cyberattacks, including those targeting containerized environments, businesses are compelled to enhance their security postures. Reports indicate that container-related vulnerabilities have surged, with a notable increase in incidents involving data breaches and unauthorized access. This alarming trend has prompted organizations to prioritize the implementation of comprehensive security measures for their containerized applications. As a result, the demand for specialized security solutions that address the unique challenges posed by containers and Kubernetes is on the rise, thereby propelling the growth of the Container And Kubernetes Security Market.

Regulatory Compliance Requirements

The Container And Kubernetes Security Market is also driven by stringent regulatory compliance requirements. Organizations are increasingly subject to various regulations that mandate the protection of sensitive data and the implementation of robust security measures. Compliance frameworks such as GDPR, HIPAA, and PCI DSS necessitate that businesses adopt security solutions that can effectively safeguard their containerized applications. As organizations strive to meet these regulatory demands, the demand for security solutions tailored for containers and Kubernetes is expected to grow. This trend highlights the critical role of compliance in shaping the security landscape, thereby influencing the Container And Kubernetes Security Market. The need for continuous monitoring and reporting further underscores the importance of investing in security solutions.

Emergence of Container Security Solutions

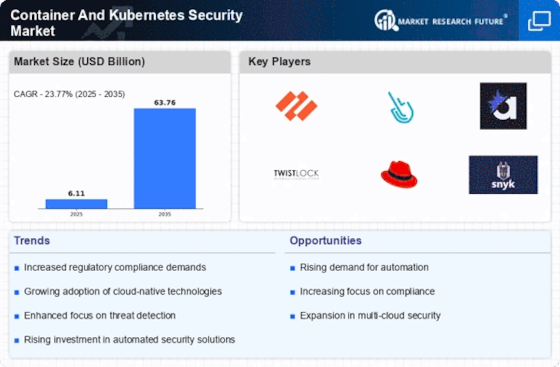

The Container And Kubernetes Security Market is experiencing the emergence of innovative container security solutions. As organizations increasingly adopt containerization, the need for specialized security tools has become apparent. New solutions are being developed to address the unique security challenges associated with containers and Kubernetes, including runtime protection, vulnerability scanning, and compliance monitoring. The market for container security solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 30% in the coming years. This growth is indicative of the increasing recognition of the importance of securing containerized environments. As organizations seek to enhance their security postures, the demand for these innovative solutions is expected to drive the Container And Kubernetes Security Market forward.

Increased Investment in DevSecOps Practices

The Container And Kubernetes Security Market is witnessing a notable increase in investment in DevSecOps practices. Organizations are recognizing the importance of integrating security into the development process, particularly in containerized environments. This shift towards a DevSecOps approach facilitates the identification and mitigation of security vulnerabilities early in the development lifecycle. As a result, businesses are allocating resources to implement security tools and practices that align with their container and Kubernetes strategies. The growing emphasis on collaboration between development, security, and operations teams is likely to drive the demand for security solutions tailored for containerized applications. This trend reflects a broader commitment to enhancing security within the Container And Kubernetes Security Market.

Growing Adoption of Cloud-Native Technologies

The Container And Kubernetes Security Market is experiencing a surge in the adoption of cloud-native technologies. Organizations are increasingly migrating their applications to cloud environments, which necessitates robust security measures. As per recent data, the market for cloud-native applications is projected to reach USD 1 trillion by 2025. This shift towards cloud-native architectures has led to a heightened focus on securing containerized applications and orchestrators like Kubernetes. Consequently, businesses are investing in advanced security solutions to protect their cloud environments, thereby driving growth in the Container And Kubernetes Security Market. The need for seamless integration of security into the development lifecycle further emphasizes the importance of security solutions tailored for containerized applications.