Europe Concrete Market Summary

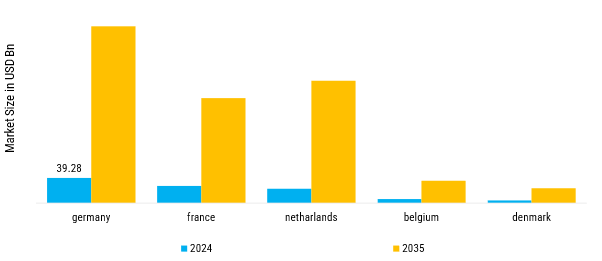

As per Market Research Future analysis, the Europe Concrete Market Size was estimated at 89.43 Billion in 2024. The Europe Concrete industry is projected to grow from 94.25 Billion in 2025 to 166.31 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Europe Concrete Market growth can be attributed to the increasing number of construction projects, the demand for durable and high-strength building materials, and the preference for cost-effective and time-saving construction methods.

- There are various problems, including changing demand and financial recessions, that currently afflict the European construction sector.

- Recent reports forecast that the sector will decline in 2024 due to reduced investment and slower growth in key regions.

- As the market responds to new opportunities and demands, signs suggest an upturn is around the corner.

- A helpful resource for businesses grappling with these challenges is Building Radar.

- Building Radar helps businesses take advantage of new opportunities by using AI to identify new development projects ahead of time.

Market Size & Forecast

| 2024 Market Size | 8,387.54 (USD Million) |

| 2035 Market Size | 58,712.04 (USD Million) |

| CAGR (2025 - 2035) | 5.8% |

Major Players

The major competitors in the market are Bouygues Construction, Sika Ag, CRH, HEIDELBERGCEMENT Ag, Holcim, Cemex, S.A.B. De C.V, Shay Murtagh Precast Ltd, Forterra, WECKENMANN ANLAGENTECHNIK GMBH & Co. Kg, Buzzi S.P.A., among others.