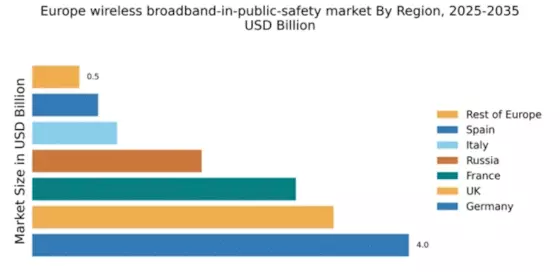

Germany : Strong Infrastructure and Demand Growth

Key markets include major cities like Berlin, Munich, and Frankfurt, where the competitive landscape is dominated by players such as Motorola Solutions and Ericsson. The presence of these major players fosters a dynamic business environment, characterized by rapid technological advancements and collaborations with local authorities. The public safety sector is increasingly adopting wireless broadband solutions for emergency response, surveillance, and disaster management, making Germany a pivotal hub for innovation in this field.

UK : Innovative Solutions for Emergency Services

Key markets include London, Manchester, and Birmingham, where the competitive landscape features significant players like Nokia and Cisco Systems. The local market dynamics are characterized by a collaborative approach between public and private sectors, fostering innovation and efficiency. The public safety sector is increasingly leveraging wireless broadband for real-time data sharing, situational awareness, and enhanced coordination among emergency responders, positioning the UK as a leader in public safety technology.

France : Government Initiatives Drive Growth

Key markets include Paris, Lyon, and Marseille, where major players like Thales Group and Ericsson are actively involved. The competitive landscape is marked by a focus on innovation and collaboration, with local authorities partnering with technology providers to implement cutting-edge solutions. The public safety sector is increasingly utilizing wireless broadband for applications such as real-time surveillance, emergency management, and inter-agency communication, making France a significant player in the European market.

Russia : Investment in Infrastructure Growth

Key markets include Moscow and St. Petersburg, where the competitive landscape features local and international players like Motorola Solutions and Harris Corporation. The business environment is characterized by a focus on public-private partnerships, enabling the deployment of innovative solutions tailored to local needs. The public safety sector is increasingly adopting wireless broadband for applications such as disaster response, surveillance, and inter-agency collaboration, positioning Russia as a growing market in this domain.

Italy : Focus on Emergency Response Solutions

Key markets include Rome, Milan, and Naples, where the competitive landscape features players like Nokia and Cisco Systems. The local market dynamics are characterized by a focus on innovation and collaboration between public authorities and technology providers. The public safety sector is increasingly leveraging wireless broadband for applications such as emergency response coordination, real-time data sharing, and surveillance, making Italy a notable player in the European market.

Spain : Investment in Digital Infrastructure

Key markets include Madrid and Barcelona, where the competitive landscape features significant players like Thales Group and Zebra Technologies. The local market dynamics are characterized by a collaborative approach between public and private sectors, fostering innovation and efficiency. The public safety sector is increasingly utilizing wireless broadband for applications such as real-time surveillance, emergency management, and inter-agency communication, positioning Spain as a growing market in this domain.

Rest of Europe : Varied Growth Across Regions

Key markets include cities across Scandinavia, Eastern Europe, and the Balkans, where the competitive landscape features a mix of local and international players. The business environment is characterized by varying levels of technological adoption and collaboration between public authorities and technology providers. The public safety sector is increasingly leveraging wireless broadband for applications such as emergency response coordination and surveillance, making the Rest of Europe a region of diverse growth potential.

Leave a Comment