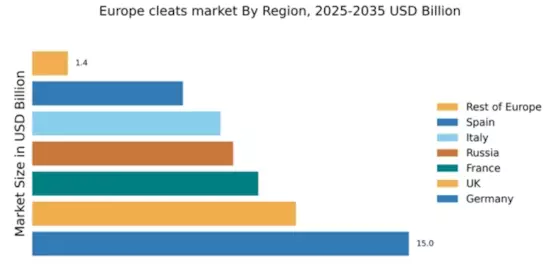

Germany : Strong Demand and Innovation Drive Growth

Germany holds a significant 15.0% market share in the European cleats market, valued at approximately €1.5 billion. Key growth drivers include a robust sports culture, increasing participation in football, and a rising trend towards performance-oriented footwear. Government initiatives promoting sports and physical activity, along with stringent quality regulations, further bolster market demand. The country’s advanced infrastructure supports efficient distribution and retail channels, enhancing accessibility for consumers.

UK : Football Culture Fuels Cleat Sales

The UK commands a 10.5% share of the European cleats market, translating to a value of around €1.1 billion. The growth is propelled by a strong football culture, with grassroots initiatives encouraging youth participation. Demand for innovative designs and sustainable materials is on the rise, influenced by consumer awareness. Regulatory frameworks support fair competition and product safety, while the retail landscape is evolving with online sales gaining traction.

France : Fashion Meets Functionality in Footwear

France holds a 9.0% market share in the cleats sector, valued at approximately €900 million. The market is driven by a blend of fashion and functionality, with consumers seeking stylish yet performance-oriented footwear. Government policies promoting sports participation and health initiatives contribute to market growth. The rise of e-commerce and local boutiques enhances consumer access to diverse brands and styles, fostering a competitive environment.

Russia : Market Expansion Through Youth Engagement

With an 8.0% market share, Russia's cleats market is valued at around €800 million. Key growth drivers include increasing youth engagement in sports and government support for athletic programs. Demand for affordable yet quality footwear is rising, influenced by local manufacturing initiatives. Regulatory policies focus on product safety and consumer rights, while urban centers like Moscow and St. Petersburg serve as key markets for major brands.

Italy : Strong Brand Loyalty in Footwear

Italy captures a 7.5% share of the cleats market, valued at approximately €750 million. The market is characterized by strong brand loyalty, particularly towards local players like Diadora. Growth is driven by a rich football heritage and increasing participation in sports. Government initiatives promoting physical education in schools support market expansion. Key cities such as Milan and Rome are central to retail activities, with a competitive landscape featuring both local and international brands.

Spain : Youth Engagement Drives Market Growth

Spain holds a 6.0% market share in the cleats market, valued at around €600 million. The growth is fueled by increasing youth participation in sports and a vibrant football culture. Demand for stylish and functional footwear is on the rise, influenced by social media trends. Regulatory frameworks ensure product quality and consumer protection, while cities like Barcelona and Madrid are pivotal in shaping market dynamics and brand presence.

Rest of Europe : Diverse Preferences Across Regions

The Rest of Europe accounts for a modest 1.42% of the cleats market, valued at approximately €140 million. This segment features niche markets with unique consumer preferences, often influenced by local sports cultures. Growth drivers include increasing awareness of health and fitness, alongside government initiatives promoting sports. The competitive landscape is fragmented, with local brands often dominating, while major players like Nike and Adidas also have a presence.