Market Share

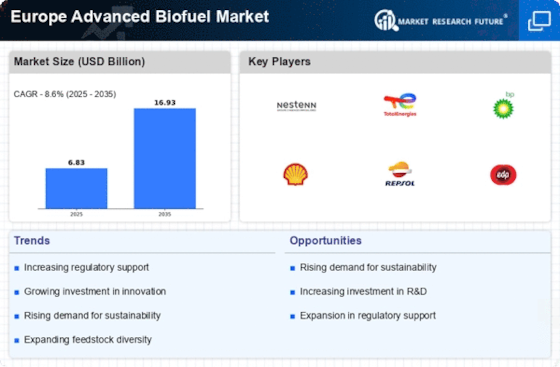

Europe Advanced Biofuel market Share Analysis

In the competitive landscape of the Europe Advanced Biofuel Market, companies employ various strategies to position themselves effectively and capture market share. One prominent approach is differentiation, where companies distinguish their biofuels from competitors' offerings based on unique features or benefits. This could involve emphasizing superior environmental sustainability, higher energy efficiency, or lower production costs. By highlighting these advantages, companies aim to attract environmentally conscious consumers and gain a competitive edge in the market.

Another key strategy is segmentation, where companies target specific customer segments or niche markets within the biofuel industry. For example, some companies may focus on supplying biofuels for commercial aviation, while others target the marine transportation sector. By tailoring their products and marketing efforts to meet the unique needs of these segments, companies can establish a strong presence and capture a larger share of the market.

Furthermore, strategic partnerships and alliances play a crucial role in market share positioning within the Europe Advanced Biofuel Market. Collaborating with key stakeholders such as government agencies, research institutions, and industry associations can provide companies with access to resources, expertise, and market opportunities that may be otherwise inaccessible. By forming strategic partnerships, companies can enhance their competitiveness, expand their market reach, and strengthen their position in the industry.

Moreover, innovation and technological advancements are integral to maintaining a competitive edge in the Europe Advanced Biofuel Market. Companies that invest in research and development to improve production processes, enhance product quality, and develop new biofuel formulations are better positioned to meet evolving customer demands and stay ahead of the competition. By continuously innovating, companies can differentiate themselves in the market and attract customers seeking cutting-edge solutions.

Additionally, effective marketing and branding strategies are essential for building brand awareness, fostering customer loyalty, and increasing market share in the Europe Advanced Biofuel Market. Companies that invest in creating compelling brand identities, communicating their value proposition effectively, and engaging with customers through various channels such as social media, events, and advertising can strengthen their position in the market and drive growth.

Furthermore, regulatory compliance and sustainability credentials are increasingly important for companies operating in the Europe Advanced Biofuel Market. With growing awareness of environmental issues and stricter regulations governing carbon emissions, consumers and businesses alike are seeking biofuel suppliers that demonstrate a commitment to sustainability and environmental responsibility. Companies that adhere to rigorous environmental standards, obtain certifications, and transparently communicate their sustainability efforts can enhance their reputation, attract environmentally conscious customers, and gain a competitive advantage in the market.

Market share positioning strategies in the Europe Advanced Biofuel Market involve a combination of differentiation, segmentation, strategic partnerships, innovation, marketing, regulatory compliance, and sustainability. By employing these strategies effectively, companies can enhance their competitiveness, attract customers, and capture a larger share of the market. As the demand for renewable energy sources continues to grow, companies that adapt to changing market dynamics and focus on delivering value to customers will be well-positioned to succeed in the Europe Advanced Biofuel Market.

Leave a Comment