Increased Focus on Cybersecurity

As the 5g ntn market expands, the focus on cybersecurity has intensified. With the proliferation of connected devices and the increasing complexity of networks, ensuring robust security measures is paramount. Cyber threats pose significant risks to both consumers and businesses, prompting stakeholders to prioritize cybersecurity in their 5g ntn strategies. In Europe, regulatory frameworks are evolving to address these concerns, with new guidelines being established to enhance network security. This heightened emphasis on cybersecurity is likely to drive investments in secure 5g ntn solutions, as companies seek to protect their infrastructure and data. Consequently, the integration of advanced security protocols within 5g ntn networks may become a key differentiator in the market.

Government Initiatives and Support

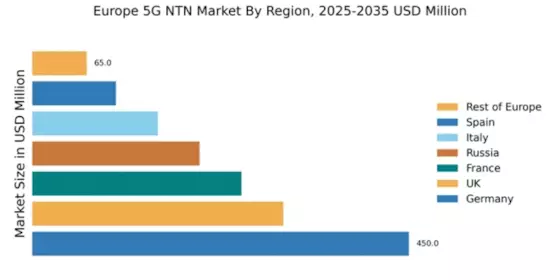

Government initiatives play a crucial role in shaping the 5g ntn market in Europe. Various European governments are actively promoting the adoption of 5g technologies through funding and policy frameworks. For instance, the European Commission has allocated substantial resources to support the development of 5g infrastructure, with an investment target of €100 billion by 2025. This financial backing is aimed at enhancing connectivity across urban and rural areas, ensuring that all citizens benefit from advanced telecommunications. Additionally, regulatory bodies are streamlining processes to facilitate quicker deployment of 5g ntn networks. Such government support not only boosts investor confidence but also encourages innovation within the telecommunications sector, further driving the growth of the 5g ntn market.

Rising Demand for High-Speed Connectivity

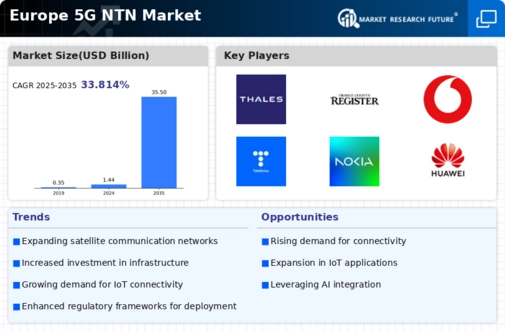

The increasing demand for high-speed connectivity in Europe is a primary driver for the 5g ntn market. As businesses and consumers alike seek faster internet speeds, the need for advanced telecommunications infrastructure becomes evident. According to recent data, the demand for mobile data is projected to grow by over 50% in the next few years. This surge in demand necessitates the deployment of 5g ntn solutions, which can provide enhanced bandwidth and lower latency. Furthermore, the proliferation of IoT devices is expected to contribute significantly to this demand, as more devices require reliable and fast connections. Consequently, telecommunications companies are investing heavily in 5g ntn technologies to meet these evolving needs, thereby propelling the market forward.

Growing Interest in Smart City Initiatives

The growing interest in smart city initiatives is a notable driver for the 5g ntn market. European cities are increasingly adopting smart technologies to improve urban living, enhance public services, and promote sustainability. The implementation of 5g ntn solutions is essential for the success of these initiatives, as they provide the necessary infrastructure for real-time data collection and analysis. For example, smart traffic management systems rely on high-speed connectivity to optimize traffic flow and reduce congestion. As cities invest in these technologies, the demand for 5g ntn services is expected to rise. Reports indicate that investments in smart city projects could reach €500 billion by 2030, further underscoring the potential for growth within the 5g ntn market.

Technological Advancements in Satellite Communication

Technological advancements in satellite communication are significantly influencing the 5g ntn market. Innovations such as low Earth orbit (LEO) satellite constellations are enabling faster and more reliable internet access, particularly in remote areas. These advancements allow for seamless integration of satellite technology with terrestrial networks, enhancing overall connectivity. As of November 2025, several companies are actively launching LEO satellites, with plans to deploy thousands of satellites to provide global coverage. This shift towards satellite-based solutions is expected to capture a substantial share of the telecommunications market, with estimates suggesting that satellite services could account for up to 20% of the total 5g ntn market by 2030. Such developments are likely to reshape the competitive landscape of the industry.