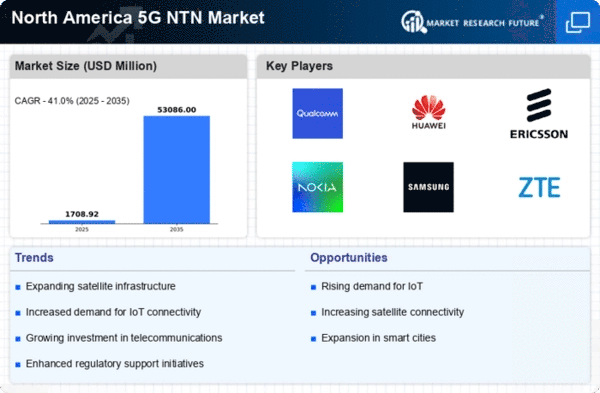

Emergence of Smart Cities

The emergence of smart cities in North America is significantly influencing the 5g ntn market. Urban areas are increasingly adopting smart technologies to enhance efficiency, sustainability, and quality of life for residents. This shift necessitates the deployment of advanced communication networks capable of supporting a multitude of connected devices and applications. For example, smart traffic management systems, energy-efficient buildings, and public safety solutions require reliable and high-speed connectivity, which 5g ntn technologies can provide. As cities invest in these initiatives, the demand for 5g ntn solutions is expected to rise. Reports indicate that investments in smart city projects could exceed $100 billion by 2025, further propelling the growth of the 5g ntn market. This trend highlights the critical role that advanced telecommunications play in shaping the future of urban living.

Increased Adoption of IoT Devices

The rapid adoption of Internet of Things (IoT) devices in North America is a significant driver for the 5g ntn market. As more devices become interconnected, the demand for reliable and high-speed communication networks intensifies. Current estimates suggest that there are over 30 billion connected devices globally, with a substantial portion located in North America. This proliferation of IoT devices necessitates the deployment of advanced network solutions, such as 5g ntn technologies, to ensure seamless connectivity and data transmission. Furthermore, industries such as healthcare, manufacturing, and transportation are increasingly leveraging IoT applications to enhance operational efficiency and improve service delivery. Consequently, the growth of the IoT ecosystem is likely to create substantial opportunities for the 5g ntn market, as service providers seek to meet the connectivity needs of these devices.

Government Initiatives and Support

Government initiatives aimed at enhancing telecommunications infrastructure play a crucial role in the growth of the 5g ntn market in North America. Various federal and state programs are being implemented to promote the deployment of advanced communication technologies. For instance, the Federal Communications Commission (FCC) has allocated substantial funding to support the expansion of broadband access, particularly in underserved areas. This funding is expected to reach approximately $20 billion over the next few years, directly impacting the 5g ntn market. Additionally, regulatory frameworks are being established to facilitate the integration of satellite technologies into existing networks, thereby encouraging investment from private sector players. Such government backing not only boosts investor confidence but also accelerates the pace of technological advancements in the 5g ntn market.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity in North America is a primary driver for the 5g ntn market. As businesses and consumers alike seek faster internet speeds, the need for advanced communication technologies becomes more pronounced. According to recent data, approximately 70% of North American households now require internet speeds exceeding 100 Mbps, which is significantly higher than previous years. This trend is pushing telecommunications companies to invest in 5g ntn solutions to meet consumer expectations. Furthermore, the proliferation of smart devices and IoT applications necessitates robust network capabilities, further fueling the growth of the 5g ntn market. As a result, service providers are likely to enhance their infrastructure to accommodate this demand, leading to increased competition and innovation within the sector.

Technological Advancements in Satellite Communication

Technological advancements in satellite communication are driving innovation within the 5g ntn market. Recent developments in low Earth orbit (LEO) satellite technology have the potential to revolutionize connectivity, particularly in rural and remote areas of North America. These advancements enable faster data transmission and lower latency, which are critical for applications such as telemedicine, remote education, and emergency services. As companies invest in LEO satellite constellations, the market for 5g ntn solutions is expected to expand significantly. Industry analysts project that the satellite communication market could reach $130 billion by 2026, with a substantial portion attributed to 5g ntn technologies. This growth underscores the importance of satellite communication in enhancing network coverage and reliability, thereby supporting the broader objectives of the 5g ntn market.