Emergence of Smart Cities

The emergence of smart cities in South America is a crucial driver for the 5g ntn market. Urban areas are increasingly adopting smart technologies to improve efficiency and quality of life for residents. This trend necessitates robust connectivity solutions, as smart city applications such as traffic management, public safety, and environmental monitoring require real-time data transmission. The investment in smart city projects is projected to reach $1 trillion by 2025 in the region, creating substantial opportunities for 5g ntn service providers. As municipalities seek to implement these technologies, the demand for advanced telecommunications infrastructure will likely surge, further propelling the market.

Growth of IoT Applications

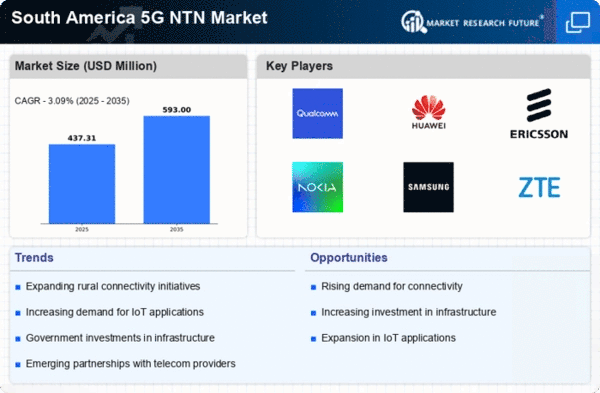

The rapid growth of Internet of Things (IoT) applications is significantly impacting the 5g ntn market in South America. As more devices become interconnected, the need for high-speed, low-latency communication becomes paramount. Industries such as agriculture, manufacturing, and logistics are increasingly adopting IoT solutions to enhance operational efficiency. For instance, the agricultural sector is leveraging IoT for precision farming, which is expected to grow at a CAGR of 25% by 2025. This proliferation of IoT devices necessitates the deployment of 5g ntn networks to support the vast data exchange required for these applications, thereby driving market growth.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity in South America is a primary driver for the 5g ntn market. As urbanization accelerates, more individuals and businesses require reliable and fast internet access. This demand is reflected in the projected growth of mobile data traffic, which is expected to reach 77 exabytes per month by 2025 in the region. The need for enhanced connectivity is particularly pronounced in sectors such as education, healthcare, and entertainment, where high-speed internet is essential for effective service delivery. Consequently, telecommunications companies are investing heavily in 5g ntn infrastructure to meet this demand, thereby propelling the market forward.

Government Initiatives for Digital Transformation

Government initiatives aimed at digital transformation are significantly influencing the 5g ntn market in South America. Various countries are implementing policies to promote the adoption of advanced technologies, including 5g networks. For instance, Brazil's National Broadband Plan aims to expand internet access to underserved areas, which is expected to boost the demand for 5g ntn services. Additionally, public-private partnerships are being encouraged to facilitate infrastructure development. These initiatives not only enhance connectivity but also stimulate economic growth, as businesses increasingly rely on digital solutions. The government's commitment to fostering a digital economy is likely to drive investments in the 5g ntn market.

Increased Investment in Telecommunications Infrastructure

Increased investment in telecommunications infrastructure is a vital driver for the 5g ntn market in South America. Telecommunications companies are recognizing the need to upgrade their networks to support the growing demand for high-speed internet and mobile services. In 2025, it is estimated that investments in telecommunications infrastructure will exceed $30 billion in the region. This influx of capital is directed towards expanding coverage, enhancing network capacity, and deploying advanced technologies such as 5g ntn. As companies strive to remain competitive, the focus on infrastructure development is likely to accelerate the adoption of 5g ntn services across various sectors.