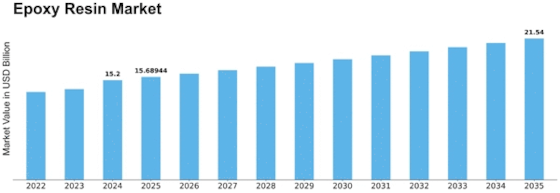

Epoxy Resin Size

Epoxy Resin Market Growth Projections and Opportunities

The epoxy resin market is influenced by a multitude of factors that collectively define its dynamics, growth, and applications across diverse industries. The following key points outline the market factors contributing to the evolution and demand for epoxy resins:

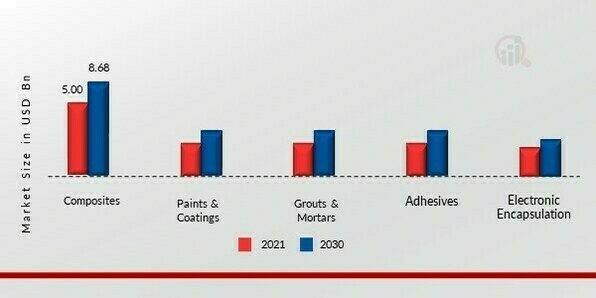

Versatile Applications Across Industries: Epoxy resins find extensive applications across various industries, including construction, electronics, automotive, aerospace, and coatings. Their versatility makes them suitable for adhesives, coatings, composites, and encapsulation, driving demand from multiple sectors.

Construction Industry Boom: The construction industry plays a pivotal role in the demand for epoxy resins. These resins are widely used in construction materials such as adhesives, sealants, and coatings due to their high strength, durability, and bonding capabilities, contributing to the growth of the epoxy resin market.

Electronics and Electrical Applications: Epoxy resins are crucial in the electronics and electrical industries for encapsulating and insulating components. Their excellent electrical insulating properties, thermal stability, and adhesive strength make them essential in the production of electronic devices, circuit boards, and electrical systems.

Booming Automotive Sector: The automotive industry utilizes epoxy resins for various applications, including adhesives, coatings, and composite materials. Epoxy-based composites contribute to lightweighting efforts, while adhesives and coatings enhance durability, corrosion resistance, and aesthetic appeal in automotive components.

Advancements in Wind Energy: The growth of the wind energy sector is a significant driver for epoxy resin demand. Epoxy resins are extensively used in the manufacturing of wind turbine blades due to their high strength-to-weight ratio, corrosion resistance, and ability to withstand harsh environmental conditions.

Adhesive and Composite Manufacturing: Epoxy resins are key components in the formulation of high-performance adhesives and composites. Their strong bonding properties, excellent adhesion to various materials, and resistance to chemicals contribute to their widespread use in manufacturing applications.

Rising Demand for Sustainable Solutions: The market is witnessing a shift towards sustainable and environmentally friendly epoxy resin formulations. Manufacturers are focusing on developing bio-based and waterborne epoxy resins to align with global sustainability goals and meet the increasing demand for eco-friendly products.

Research and Development Initiatives: Ongoing research and development efforts in epoxy resin formulations drive innovation in the market. Manufacturers invest in developing epoxy resins with enhanced properties, improved curing mechanisms, and novel applications, contributing to market growth and differentiation.

Infrastructure Development: Large-scale infrastructure projects, including bridges, tunnels, and architectural structures, contribute to the demand for epoxy resins. Their use in construction materials provides durability, corrosion resistance, and structural integrity, making them integral to modern infrastructure development.

Global Supply Chain Dynamics: Epoxy resin production is influenced by global supply chain dynamics, including the availability and pricing of raw materials such as epichlorohydrin and bisphenol. Fluctuations in raw material costs, geopolitical factors, and supply chain disruptions can impact the overall epoxy resin market.

Demand for High-Performance Coatings: Epoxy resins are extensively used in high-performance coatings for various applications, including industrial, marine, and aerospace coatings. The demand for coatings that offer superior protection, durability, and resistance to harsh conditions contributes to the growth of the epoxy resin market.

Adherence to Regulatory Standards: Compliance with regulatory standards and environmental regulations is a crucial factor shaping the epoxy resin market. Manufacturers and end-users prioritize epoxy resin formulations that meet stringent safety, health, and environmental requirements, influencing product choices and market trends.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Leave a Comment