Market Share

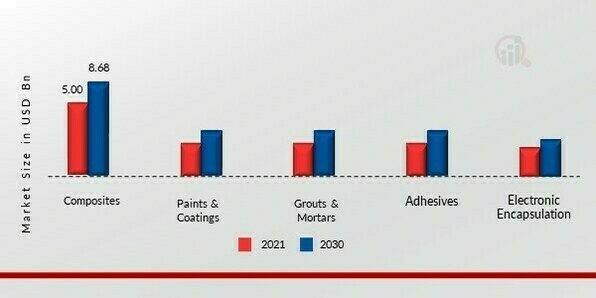

Epoxy Resin Market Share Analysis

The Epoxy Resin Market employs various market share positioning strategies to distinguish companies and secure a competitive advantage in this dynamic industry. These strategies encompass product differentiation, market segmentation, environmental sustainability, strategic partnerships, research and development investment, brand positioning, cost leadership, global expansion, customer relationship management, and quality assurance.

Product Differentiation:

Specialized Formulations: Companies focus on developing epoxy resin formulations with unique properties or applications, catering to specific industry needs. Innovative formulations can set a product apart in a crowded market. High-Performance Applications: Positioning epoxy resins for high-performance applications, such as aerospace or electronics, allows companies to target industries requiring advanced material properties. Market Segmentation:

Industry-Specific Focus: Tailoring epoxy resin offerings to cater to specific industries, like construction, automotive, or marine, enables companies to address distinct market demands and challenges. Geographical Targeting: Companies may adopt strategies to meet the epoxy resin requirements prevalent in specific regions, considering factors such as climate, regulatory standards, and local industry practices. Environmental Sustainability:

Green Formulations: The increasing emphasis on sustainability leads companies to develop epoxy resins with reduced environmental impact. Formulations that are low in volatile organic compounds (VOCs) or derived from renewable sources align with eco-friendly trends. Recyclability and Biodegradability: Highlighting the recyclability and biodegradability of epoxy resin products contributes to sustainability goals and appeals to environmentally conscious customers. Strategic Partnerships and Alliances:

Collaboration with End-Users: Forming strategic partnerships with end-users, such as construction companies or manufacturers, allows epoxy resin suppliers to understand specific application needs and co-develop tailored solutions. Collaborative Supply Chain: Partnerships with distributors and raw material suppliers optimize the supply chain, ensuring efficient product delivery and enhancing the overall customer experience. Investment in Research and Development:

Continuous Innovation: Companies that allocate significant resources to research and development gain a competitive edge by introducing new and improved epoxy resin formulations. Staying ahead in innovation allows companies to lead the market. Adapting to Industry Trends: Anticipating and adapting to industry trends, such as advancements in nanotechnology or bio-based materials, enables companies to offer cutting-edge epoxy resin solutions. Brand Positioning and Marketing:

Effective Branding: Building a strong brand presence and identity is crucial for standing out in the epoxy resin market. Effective marketing strategies, including targeted advertising and promotions, contribute to increased visibility and brand recognition. Educational Campaigns: Informative campaigns that educate customers about the diverse applications and benefits of specific epoxy resin formulations create awareness and position a company as an industry leader. Cost Leadership Strategies:

Economies of Scale: Achieving economies of scale through efficient production processes and large-scale manufacturing allows companies to offer competitive pricing without compromising product quality. Cost-Efficiency Measures: Implementing cost-efficiency measures throughout the production and supply chain ensures companies maintain profitability while providing cost-competitive epoxy resin solutions. Global Expansion Strategies:

Entering Emerging Markets: Identifying and entering emerging markets provides opportunities for growth and expansion. Tailoring products to meet the unique demands of these markets ensures relevance and competitiveness. Global Distribution Networks: Establishing a robust global distribution network allows companies to reach a wider customer base. Expanding market reach enhances the potential for increased market share. Customer Relationship Management:

Proactive Customer Support: Offering excellent customer support services, including technical assistance and training programs, strengthens the relationship between companies and their clients. Feedback Integration: Actively seeking and incorporating customer feedback into product development and improvement processes demonstrates a commitment to meeting customer needs. Quality Assurance and Certification:

Stringent Quality Standards: Adhering to strict quality control measures and obtaining relevant certifications assures customers of the reliability and performance of epoxy resin products. Compliance with Industry Standards: Aligning products with industry standards and regulations builds trust among customers and positions a company as a responsible and dependable supplier.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Leave a Comment