Epoxy Resin Curing Agents Market Summary

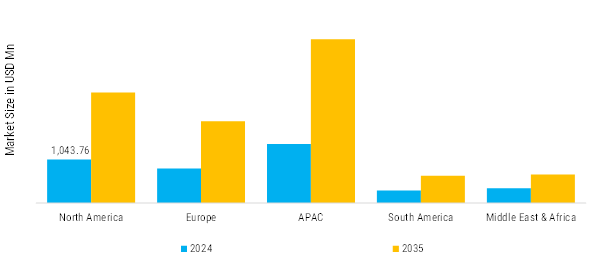

As per Market Research Future analysis, the Epoxy Resin Curing Agents Market Size was estimated at 3959.92 USD Million in 2024. The Epoxy Resin Curing Agents industry is projected to grow from 4248.91 USD Million in 2025 to 9901.11 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 8.8 % during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Epoxy Resin Curing Agents Market is experiencing strong and accelerating growth, driven by increasing focus on eco‑friendly, low‑VOC, and bio‑based curing agent formulations.

- There is strong demand for waterborne and solvent‑free epoxy curing systems that offer lower environmental impact while maintaining performance. These formulations are gaining traction in construction, coatings, and industrial applications due to regulatory pressure and corporate sustainability goals.

- Performance enhancements through technological innovation are driving product differentiation. This includes fast‑curing agents, nano‑enhanced curing systems, and specialty techniques that improve mechanical strength, thermal resistance, and curing efficiency. These innovations support high‑performance applications in aerospace, automotive, and electronics.

- Sustainability trends are extending beyond chemistry to packaging and lifecycle considerations, with a push for recyclable or reduced plastic packaging, concentrated formulations (to cut transport emissions), and compliance with green standards influencing buyer choices.

- Bio‑based epoxy curing agents derived from renewable materials (e.g., plant oils, bio‑phenols) are emerging as a growth segment, combining comparable performance with reduced ecological footprint. This sub‑segment is expected to grow at a notable CAGR due to rising environmental awareness and policy support in key regions.

Market Size & Forecast

| 2024 Market Size | 3959.92 (USD Million) |

| 2035 Market Size | 9901.11 (USD Million) |

| CAGR (2025 - 2035) | 8.8 % |

Major Players

BASF SE, Huntsman Corporation, Evonik, Mitsubishi Chemical Corporation, DIC CORPORATION, Olin Corporation, Atul Ltd, Aditya Birla, Air Products Inc, T&K TOKA Corporation, and Balaji Amines.