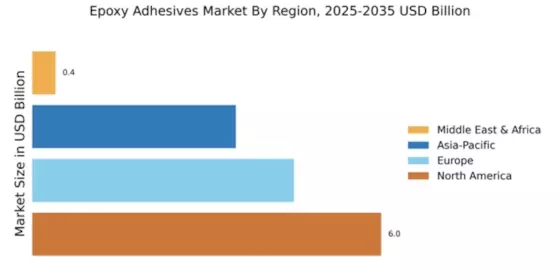

North America : Market Leader in Adhesives

North America is poised to maintain its leadership in the epoxy adhesives market, holding a significant share of 6.0 in 2025. The region's growth is driven by robust demand from the automotive, aerospace, and construction sectors, alongside stringent regulations promoting high-performance materials. The increasing focus on sustainability and innovation further propels market expansion, with companies investing in eco-friendly formulations and advanced technologies.

The United States stands as the largest market, supported by key players like Huntsman Corporation, 3M Company, and Dow Inc. These companies are leveraging advanced R&D capabilities to enhance product offerings. The competitive landscape is characterized by strategic partnerships and mergers, aimed at expanding market reach and improving product portfolios. As a result, North America is expected to continue its dominance in The Epoxy Adhesives.

Europe : Innovation and Sustainability Focus

Europe's epoxy adhesives market is projected to reach 4.5 by 2025, driven by increasing demand for sustainable and high-performance materials across various industries. Regulatory frameworks, such as REACH, are pushing manufacturers to innovate and develop eco-friendly products, enhancing market growth. The automotive and construction sectors are particularly influential, as they seek adhesives that meet stringent performance and environmental standards.

Germany, France, and the UK are leading countries in this market, with major players like Henkel AG and BASF SE driving innovation. The competitive landscape is marked by a strong emphasis on R&D, with companies investing in new technologies to meet evolving consumer demands. As a result, Europe is becoming a hub for advanced adhesive solutions, positioning itself as a key player in the global market.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the epoxy adhesives market, projected to reach 3.5 by 2025. This growth is fueled by rapid industrialization, urbanization, and increasing demand from sectors such as electronics, automotive, and construction. Governments are also implementing favorable policies to boost manufacturing, which is expected to further drive market expansion. The region's focus on innovation and technology adoption is enhancing the performance of epoxy adhesives.

China, Japan, and India are the leading countries in this market, with a growing presence of key players like Sika AG and Momentive Performance Materials. The competitive landscape is evolving, with local manufacturers emerging alongside established global companies. This dynamic environment is fostering innovation and driving down costs, making Asia-Pacific a vital region for the future of epoxy adhesives.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the epoxy adhesives market, with a market size of 0.4 projected for 2025. The growth is primarily driven by increasing construction activities and a rising demand for high-performance adhesives in various applications. Governments are investing in infrastructure development, which is expected to create new opportunities for adhesive manufacturers. Additionally, the region's focus on diversifying economies is fostering a conducive environment for market growth.

Countries like the UAE and South Africa are leading the way, with a growing number of local and international players entering the market. The competitive landscape is characterized by a mix of established companies and new entrants, all vying for market share. As the region continues to develop, the epoxy adhesives market is expected to gain momentum, presenting significant opportunities for growth.