Rising Incidence of Epilepsy

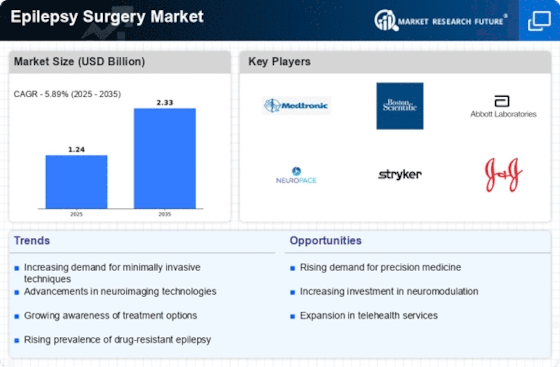

The increasing prevalence of epilepsy is a primary driver for the Epilepsy Surgery Market. Recent estimates indicate that approximately 50 million individuals worldwide are affected by epilepsy, with a significant portion experiencing drug-resistant seizures. This growing patient population necessitates advanced treatment options, including surgical interventions. As awareness of epilepsy and its impact on quality of life expands, more patients and healthcare providers are likely to consider surgery as a viable option. The Epilepsy Surgery Market is thus poised for growth, as the demand for effective surgical solutions rises in response to the increasing incidence of this neurological disorder.

Advancements in Surgical Techniques

Innovations in surgical techniques and technologies are transforming the landscape of the Epilepsy Surgery Market. Techniques such as minimally invasive surgery, laser ablation, and stereotactic surgery have emerged, offering patients safer and more effective treatment options. These advancements not only enhance surgical outcomes but also reduce recovery times, making surgery a more appealing choice for patients. The market is witnessing a surge in the adoption of these advanced techniques, as they demonstrate improved efficacy in controlling seizures. Consequently, the Epilepsy Surgery Market is likely to experience significant growth driven by these technological advancements.

Rising Awareness of Treatment Options

The increasing awareness of available treatment options for epilepsy is a vital driver for the Epilepsy Surgery Market. Educational campaigns and advocacy efforts are helping to inform patients and healthcare professionals about the potential benefits of surgical interventions for drug-resistant epilepsy. As more individuals become aware of the possibility of surgery, the demand for these procedures is likely to rise. This heightened awareness is also encouraging healthcare providers to refer patients for surgical evaluation, further driving market growth. The Epilepsy Surgery Market stands to gain from this trend as more patients seek effective solutions for managing their condition.

Growing Research and Development Activities

The Epilepsy Surgery Market is significantly influenced by the growing emphasis on research and development activities. Ongoing studies aim to better understand the underlying mechanisms of epilepsy and identify optimal surgical candidates. This research is crucial for developing innovative surgical techniques and improving existing procedures. Furthermore, collaborations between academic institutions and healthcare providers are fostering advancements in surgical methodologies. As new findings emerge, they are likely to enhance the efficacy of epilepsy surgeries, thereby attracting more patients to consider surgical options. The focus on R&D is expected to propel the Epilepsy Surgery Market forward.

Increased Investment in Healthcare Infrastructure

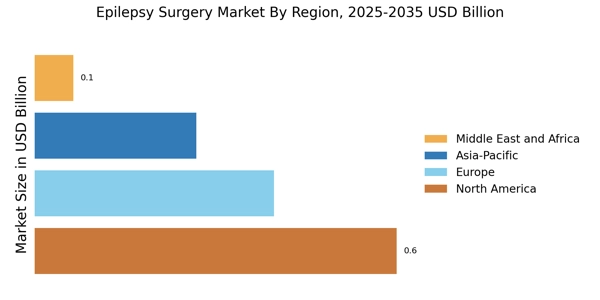

Investment in healthcare infrastructure is a crucial driver for the Epilepsy Surgery Market. Governments and private entities are increasingly allocating resources to enhance healthcare facilities and improve access to specialized treatments. This trend is particularly evident in regions with high epilepsy prevalence, where the establishment of dedicated epilepsy centers is on the rise. Enhanced infrastructure facilitates the availability of advanced surgical options and specialized care, thereby encouraging more patients to seek surgical interventions. As healthcare systems evolve, the Epilepsy Surgery Market is expected to benefit from this increased investment, leading to improved patient outcomes and market expansion.