Rising Incidence of Epilepsy

The UK Epilepsy Surgery Market is experiencing growth due to the rising incidence of epilepsy among the population. Recent estimates suggest that approximately 600,000 people in the UK are living with epilepsy, with around 30% of these individuals being resistant to standard antiepileptic medications. This growing patient population necessitates the exploration of surgical options, thereby driving demand for epilepsy surgery. Furthermore, the National Health Service (NHS) has recognized the need for improved treatment pathways, which may lead to increased referrals for surgical evaluation. As awareness of epilepsy and its treatment options expands, the UK Epilepsy Surgery Market is likely to see a corresponding increase in surgical interventions, ultimately improving patient outcomes and quality of life.

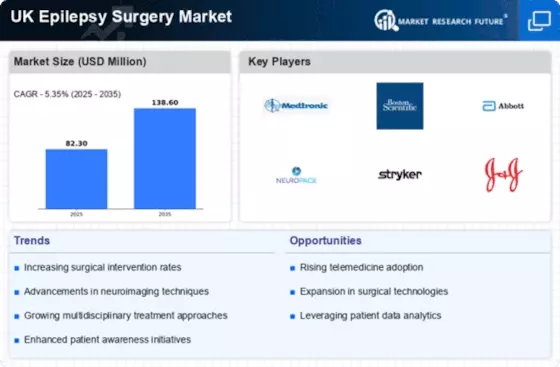

Advancements in Imaging Techniques

Advancements in imaging techniques, such as functional MRI and PET scans, are significantly influencing the UK Epilepsy Surgery Market. These technologies enable more accurate localization of epileptic foci, which is crucial for successful surgical outcomes. Enhanced imaging capabilities allow for better patient selection and pre-surgical planning, thereby increasing the likelihood of favorable results. As hospitals and surgical centers adopt these advanced imaging modalities, the UK Epilepsy Surgery Market is expected to benefit from improved surgical precision and efficacy. This trend may lead to a higher volume of surgeries performed, as clinicians become more confident in their ability to target the source of seizures effectively.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and funding for epilepsy treatment are pivotal in shaping the UK Epilepsy Surgery Market. The NHS has implemented various programs to enhance the diagnosis and treatment of epilepsy, including the establishment of specialized epilepsy surgery centers. These centers are designed to provide comprehensive evaluations and surgical options for patients with drug-resistant epilepsy. Additionally, funding allocations for epilepsy research and treatment have increased, which may facilitate advancements in surgical techniques and technologies. As a result, the UK Epilepsy Surgery Market is poised for growth, as more patients gain access to potentially life-altering surgical interventions.

Growing Multidisciplinary Approach

The growing emphasis on a multidisciplinary approach to epilepsy management is reshaping the UK Epilepsy Surgery Market. Collaborative care models that involve neurologists, neurosurgeons, psychologists, and other healthcare professionals are becoming increasingly common. This integrated approach ensures comprehensive evaluation and treatment planning for patients with epilepsy, particularly those who may be candidates for surgery. By fostering collaboration among specialists, the likelihood of successful surgical outcomes is enhanced, which may encourage more patients to consider surgical options. Consequently, the UK Epilepsy Surgery Market is likely to experience growth as multidisciplinary teams work together to optimize patient care and outcomes.

Increased Patient Advocacy and Support Groups

Increased patient advocacy and the presence of support groups are playing a crucial role in the UK Epilepsy Surgery Market. Organizations dedicated to raising awareness about epilepsy and its treatment options are empowering patients to seek surgical interventions when necessary. These advocacy groups provide valuable resources and information, helping patients understand their condition and the potential benefits of surgery. As more individuals become informed about their treatment options, the demand for epilepsy surgery is expected to rise. This trend may lead to a more robust UK Epilepsy Surgery Market, as patients actively pursue surgical solutions to manage their epilepsy effectively.