North America : Market Leader in Water Services

North America leads the Environmental Water Testing and Treatment Services Market, holding a significant share of 6.0 in 2024. The region's growth is driven by stringent regulations on water quality and increasing public awareness regarding environmental issues. The demand for advanced testing technologies and treatment solutions is on the rise, fueled by both industrial and municipal needs. Regulatory bodies are enforcing compliance, which further propels market expansion.

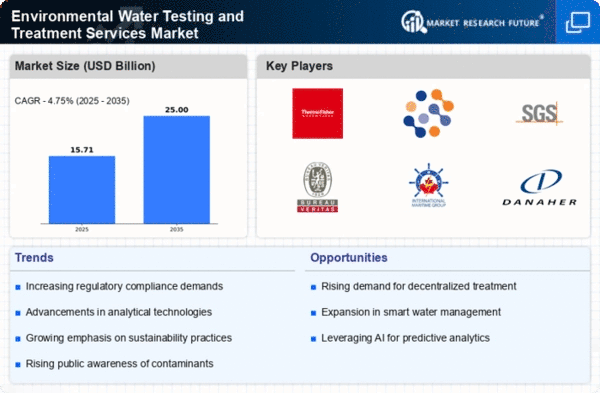

The competitive landscape in North America is robust, featuring key players such as Thermo Fisher Scientific, Danaher Corporation, and TestAmerica Laboratories. The U.S. is the primary market, supported by a strong infrastructure for environmental services. Companies are investing in innovative technologies to enhance service offerings, ensuring they meet the evolving regulatory standards and consumer expectations. This dynamic environment positions North America as a pivotal player in the global market.

Europe : Regulatory Framework Driving Growth

Europe's Environmental Water Testing and Treatment Services Market is valued at 4.5, reflecting a growing emphasis on environmental sustainability and compliance with EU regulations. The region's growth is propelled by initiatives aimed at improving water quality and reducing pollution. Regulatory frameworks, such as the Water Framework Directive, mandate rigorous testing and treatment protocols, driving demand for advanced services and technologies.

Leading countries in this market include Germany, France, and the UK, where companies like Eurofins Scientific and Bureau Veritas are prominent. The competitive landscape is characterized by a mix of established firms and innovative startups, all striving to meet stringent regulatory requirements. The presence of key players ensures a diverse range of services, catering to both public and private sectors, thus enhancing market resilience and growth potential.

Asia-Pacific : Emerging Market with Growth Potential

The Asia-Pacific region, with a market size of 3.5, is witnessing rapid growth in Environmental Water Testing and Treatment Services. This expansion is driven by increasing industrialization, urbanization, and a rising population, leading to heightened demand for clean water. Governments are implementing stricter regulations to address water quality issues, which is further stimulating market growth. The region's focus on sustainable development is also a key driver.

Countries like China, India, and Japan are at the forefront of this market, with significant investments in water infrastructure and treatment technologies. The competitive landscape features both local and international players, including SGS and Intertek Group, who are adapting to the unique challenges of the region. As awareness of environmental issues grows, the demand for comprehensive testing and treatment services is expected to rise, positioning Asia-Pacific as a vital market in the global landscape.

Middle East and Africa : Developing Market with Challenges

The Middle East and Africa region, with a market size of 1.0, is developing its Environmental Water Testing and Treatment Services Market amidst various challenges. Water scarcity and pollution are critical issues, prompting governments to invest in water quality management and treatment solutions. The region's growth is supported by international aid and investments aimed at improving water infrastructure and services, addressing both public health and environmental concerns.

Leading countries in this region include South Africa and the UAE, where initiatives are being launched to enhance water quality standards. The competitive landscape is evolving, with both local firms and international players like Pace Analytical Services entering the market. As the region grapples with water-related challenges, the demand for effective testing and treatment services is expected to grow, highlighting the importance of sustainable practices in water management.