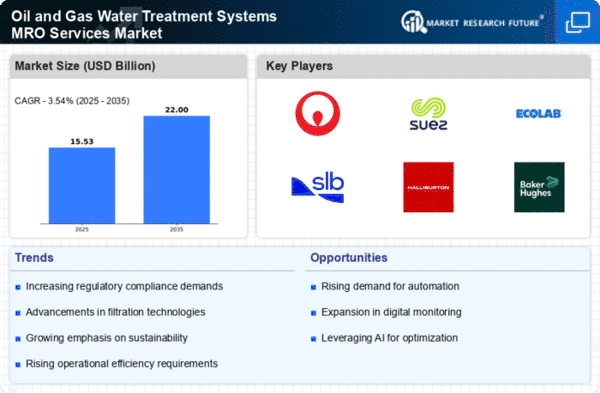

The Oil and Gas Water Treatment Systems MRO Services Market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Veolia (FR), Ecolab (US), and Schlumberger (US) are actively pursuing strategies that emphasize technological advancements and operational efficiency. Veolia (FR) focuses on enhancing its service offerings through digital transformation, while Ecolab (US) emphasizes sustainability in its water treatment solutions. Schlumberger (US), on the other hand, is leveraging its extensive expertise in oilfield services to integrate advanced water treatment technologies, thereby positioning itself as a leader in the market. Collectively, these strategies contribute to a dynamic competitive environment where differentiation is increasingly based on technological capabilities and service quality.The market structure appears moderately fragmented, with a mix of established players and emerging companies vying for market share. Key business tactics such as localizing manufacturing and optimizing supply chains are prevalent among major players. For instance, companies are increasingly investing in regional facilities to enhance responsiveness to local market demands and reduce logistical costs. This localized approach not only improves operational efficiency but also strengthens customer relationships, thereby fostering loyalty in a competitive landscape.

In November Ecolab (US) announced a strategic partnership with a leading oil and gas company to develop innovative water treatment solutions aimed at reducing environmental impact. This collaboration is significant as it underscores Ecolab's commitment to sustainability and positions the company to capitalize on the growing demand for eco-friendly solutions in the oil and gas sector. The partnership is expected to enhance Ecolab's market presence and drive revenue growth through the introduction of cutting-edge technologies.

In October Schlumberger (US) launched a new digital platform designed to optimize water management processes for oil and gas operators. This initiative is crucial as it reflects the industry's shift towards digitalization, enabling clients to monitor and manage water treatment operations in real-time. By integrating advanced analytics and AI capabilities, Schlumberger aims to improve operational efficiency and reduce costs, thereby reinforcing its competitive edge in the market.

In September Veolia (FR) expanded its operations in North America by acquiring a regional water treatment company. This acquisition is strategically important as it enhances Veolia's service capabilities and market reach in a key region. The move aligns with the company's growth strategy, allowing it to offer a broader range of services and strengthen its position against competitors in the North American market.

As of December current trends in the Oil and Gas Water Treatment Systems MRO Services Market indicate a strong emphasis on digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise to address complex challenges. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly competitive environment.