Advancements in Flash Storage Technology

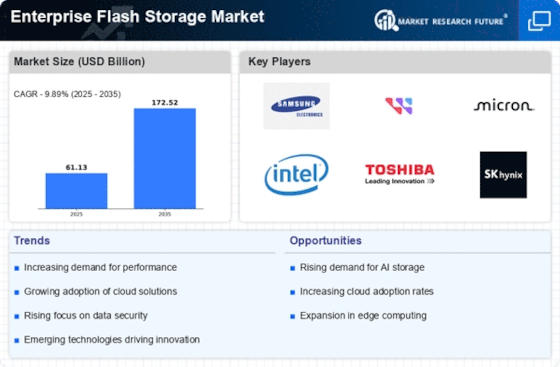

Technological innovations in flash storage are significantly influencing the Enterprise Flash Storage Market. Developments such as 3D NAND technology and NVMe interfaces have enhanced the performance and capacity of flash storage solutions. These advancements allow for faster data access and improved endurance, making flash storage an attractive option for enterprises. The market for flash storage is expected to grow at a compound annual growth rate of approximately 20% over the next few years, driven by these technological improvements. As organizations increasingly prioritize speed and efficiency in their IT infrastructure, the adoption of advanced flash storage solutions is likely to accelerate, further propelling the growth of the Enterprise Flash Storage Market.

Rising Adoption of Hybrid Cloud Solutions

The shift towards hybrid cloud environments is reshaping the Enterprise Flash Storage Market. Organizations are increasingly adopting hybrid cloud strategies to balance the benefits of on-premises and cloud storage solutions. This trend is driven by the need for flexibility, scalability, and cost-effectiveness in data management. Flash storage plays a crucial role in hybrid cloud architectures, providing the speed required for real-time data processing and analytics. As enterprises seek to optimize their storage solutions, the integration of flash storage within hybrid cloud frameworks is expected to grow. This evolution indicates a promising outlook for the Enterprise Flash Storage Market, as businesses look to enhance their data management capabilities.

Increasing Data Generation and Storage Needs

The exponential growth in data generation across various sectors is a primary driver for the Enterprise Flash Storage Market. Organizations are increasingly reliant on data analytics, which necessitates robust storage solutions capable of handling vast amounts of information. According to recent estimates, data creation is projected to reach 175 zettabytes by 2025, compelling enterprises to adopt high-performance storage systems. Flash storage, with its superior speed and efficiency, is well-positioned to meet these demands. As businesses strive to enhance their operational efficiency and decision-making processes, the need for scalable and reliable storage solutions becomes paramount. This trend indicates a sustained growth trajectory for the Enterprise Flash Storage Market, as companies seek to leverage their data assets effectively.

Growing Focus on Data Security and Compliance

As data breaches and cyber threats become more prevalent, the emphasis on data security and compliance is intensifying within the Enterprise Flash Storage Market. Organizations are increasingly investing in secure storage solutions that offer encryption and robust access controls. Flash storage solutions are often equipped with advanced security features, making them a preferred choice for enterprises concerned about data integrity and compliance with regulations such as GDPR and HIPAA. The market for secure storage solutions is projected to expand, driven by the need for organizations to protect sensitive information. This focus on security is likely to bolster the growth of the Enterprise Flash Storage Market, as companies prioritize safeguarding their data assets.

Demand for Enhanced Performance in Business Applications

The need for enhanced performance in business applications is a significant driver of the Enterprise Flash Storage Market. As organizations increasingly rely on applications that require rapid data access and processing, the limitations of traditional storage solutions become apparent. Flash storage offers superior performance, enabling faster transaction processing and improved user experiences. Industries such as finance, healthcare, and e-commerce are particularly reliant on high-performance storage solutions to support their critical applications. The demand for flash storage in these sectors is expected to rise, as businesses seek to maintain a competitive edge through improved operational efficiency. This trend suggests a robust growth potential for the Enterprise Flash Storage Market in the coming years.