Increased Focus on Energy Resilience

The Energy Storage As A Service Market is increasingly focused on enhancing energy resilience, particularly in regions prone to natural disasters or grid instability. As climate change intensifies, the need for reliable energy sources becomes critical. Energy storage systems provide backup power during outages, ensuring continuity for essential services. Recent studies indicate that energy storage can reduce the impact of outages by up to 50%, making it an attractive option for both residential and commercial users. This emphasis on resilience is prompting governments and organizations to invest in energy storage solutions, thereby driving growth in the Energy Storage As A Service Market.

Integration with Smart Grid Technologies

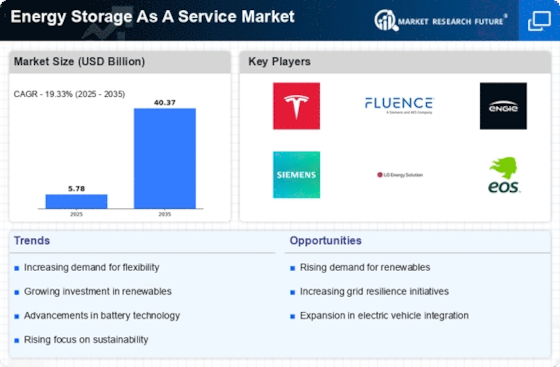

The Energy Storage As A Service Market is benefiting from the integration of smart grid technologies, which enhance the efficiency and reliability of energy distribution. Smart grids facilitate real-time monitoring and management of energy resources, allowing for better coordination between energy supply and demand. This integration is expected to create a more dynamic energy landscape, where energy storage systems play a crucial role in balancing loads and optimizing energy use. As smart grid adoption accelerates, the Energy Storage As A Service Market is likely to expand, with projections indicating a compound annual growth rate of over 20% in the coming years. This synergy between energy storage and smart grid technologies is pivotal for achieving sustainable energy goals.

Growing Demand for Flexible Energy Solutions

The Energy Storage As A Service Market is experiencing a notable surge in demand for flexible energy solutions. As businesses and consumers seek to optimize energy usage, the need for adaptable storage options becomes paramount. This trend is driven by the increasing integration of renewable energy sources, which often produce variable outputs. According to recent data, the energy storage market is projected to reach a capacity of over 300 GWh by 2025, indicating a robust growth trajectory. This flexibility allows users to manage energy costs effectively, particularly during peak demand periods. Consequently, service providers are innovating to offer tailored solutions that meet diverse customer needs, thereby enhancing the overall appeal of energy storage services.

Cost Reductions in Energy Storage Technologies

The Energy Storage As A Service Market is witnessing significant cost reductions in energy storage technologies, particularly lithium-ion batteries. The price of these batteries has decreased by approximately 85% over the past decade, making energy storage solutions more accessible to a broader range of consumers and businesses. This decline in costs is attributed to advancements in manufacturing processes and economies of scale. As a result, the market is expected to expand, with estimates suggesting that the energy storage capacity could exceed 500 GWh by 2030. Lower costs not only facilitate the adoption of energy storage systems but also encourage investment in related infrastructure, further propelling the growth of the Energy Storage As A Service Market.

Rising Environmental Awareness and Sustainability Goals

The Energy Storage As A Service Market is increasingly influenced by rising environmental awareness and sustainability goals among consumers and businesses. As organizations strive to reduce their carbon footprints, energy storage solutions are becoming essential components of sustainable energy strategies. The transition to cleaner energy sources is prompting investments in energy storage systems that can store excess renewable energy for later use. Recent surveys indicate that over 70% of companies are prioritizing sustainability in their operations, which is likely to drive demand for energy storage services. This growing emphasis on environmental responsibility is expected to significantly contribute to the expansion of the Energy Storage As A Service Market.