North America : Market Leader in Repair Services

North America is poised to maintain its leadership in the Energy Metering Systems Repair Services market, holding a significant share of 3.25 billion. The region's growth is driven by increasing energy consumption, stringent regulatory frameworks, and a push for smart grid technologies. The demand for efficient energy management solutions is further catalyzed by government incentives aimed at modernizing infrastructure and enhancing energy efficiency.

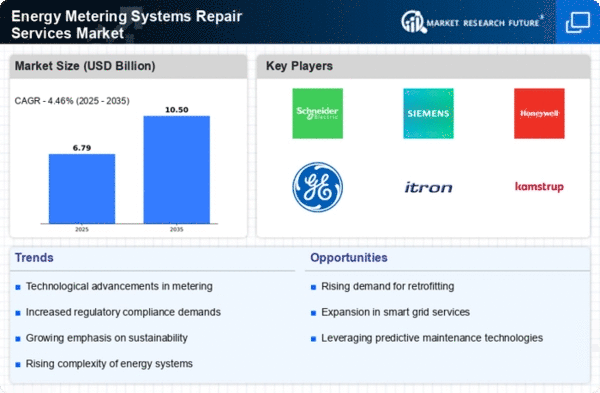

The competitive landscape in North America is robust, featuring key players such as Schneider Electric, Honeywell, and General Electric. These companies are investing heavily in R&D to innovate and improve service offerings. The U.S. and Canada are the leading countries, with a strong focus on integrating advanced metering infrastructure. This competitive environment fosters collaboration and partnerships, ensuring sustained growth in the sector.

Europe : Emerging Market with Regulations

Europe's Energy Metering Systems Repair Services market is valued at 1.8 billion, driven by regulatory mandates for energy efficiency and sustainability. The European Union's directives on energy consumption and emissions reduction are significant catalysts for market growth. Countries are increasingly adopting smart metering solutions, which require ongoing repair and maintenance services, thus enhancing market demand.

Leading countries in this region include Germany, France, and the UK, where companies like Siemens and Landis+Gyr are prominent. The competitive landscape is characterized by a mix of established players and emerging startups focusing on innovative repair solutions. The presence of stringent regulations ensures that companies prioritize quality and compliance, further driving market dynamics.

Asia-Pacific : Rapid Growth in Emerging Economies

The Asia-Pacific region, with a market size of 1.7 billion, is witnessing rapid growth in Energy Metering Systems Repair Services. This growth is fueled by urbanization, increasing energy demands, and government initiatives aimed at enhancing energy efficiency. Countries like China and India are investing heavily in smart grid technologies, which necessitate ongoing repair and maintenance services, thus driving market expansion.

China and India are the leading markets in this region, with significant contributions from local and international players. Companies such as Itron and Kamstrup are expanding their presence, focusing on innovative solutions tailored to local needs. The competitive landscape is evolving, with a mix of established firms and new entrants, fostering a dynamic environment for growth and innovation.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, valued at 0.75 billion, presents a unique landscape for Energy Metering Systems Repair Services. The market is driven by increasing energy consumption and the need for improved infrastructure. Governments are recognizing the importance of energy efficiency, leading to initiatives that promote smart metering solutions, although challenges remain in terms of regulatory frameworks and investment.

Leading countries in this region include South Africa and the UAE, where companies like Sensus and Elster Group are making strides. The competitive landscape is characterized by a mix of local and international players, each vying for market share. Despite the challenges, the potential for growth is significant as countries work towards modernizing their energy infrastructure and improving service delivery.