Rising Adoption of Solar Energy

The Encapsulant Material for PV Module Market is significantly influenced by the rising adoption of solar energy across various sectors. As countries strive to meet renewable energy targets, the demand for efficient solar panels is escalating. This trend is reflected in the increasing installations of photovoltaic systems, which are expected to reach over 1,000 GW by 2025. Consequently, the need for high-quality encapsulant materials that ensure the longevity and efficiency of solar modules is paramount. The encapsulant materials play a critical role in protecting solar cells from environmental factors, thereby enhancing their performance and reliability.

Emerging Markets and Economic Growth

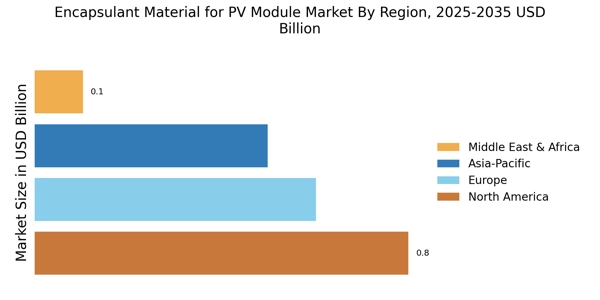

The Encapsulant Material for PV Module Market is poised for growth in emerging markets, where economic development is driving the demand for renewable energy solutions. Countries in Asia and Africa are increasingly investing in solar energy to address energy shortages and promote sustainable development. This trend is reflected in the rising number of solar installations in these regions, which is expected to double by 2025. As these markets expand, the demand for high-quality encapsulant materials that enhance the efficiency and durability of photovoltaic modules will likely increase, presenting significant opportunities for manufacturers.

Environmental Regulations and Standards

The Encapsulant Material for PV Module Market is also shaped by stringent environmental regulations and standards aimed at promoting sustainable practices. Governments are increasingly mandating the use of eco-friendly materials in solar panel production, which drives the demand for innovative encapsulants that comply with these regulations. For example, the introduction of regulations that limit the use of hazardous substances in solar products has led to a shift towards safer, more sustainable encapsulant materials. This regulatory landscape is likely to propel the market forward, as manufacturers seek to align their products with these evolving standards.

Technological Innovations in Encapsulant Materials

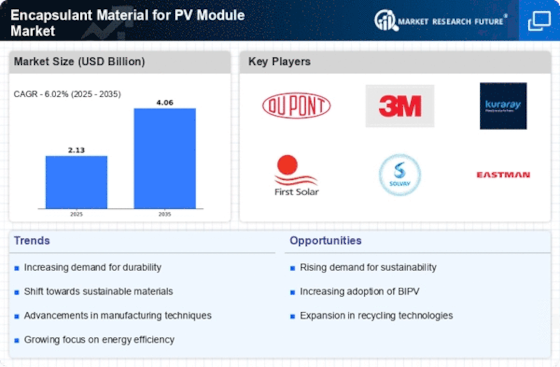

The Encapsulant Material for PV Module Market is experiencing a surge in technological innovations, particularly in the development of advanced polymer materials. These innovations enhance the durability and efficiency of photovoltaic modules, which is crucial for meeting the increasing energy demands. For instance, the introduction of ethylene-vinyl acetate (EVA) with improved thermal stability and UV resistance has been pivotal. As a result, manufacturers are likely to adopt these advanced materials to improve module performance and longevity. The market for encapsulant materials is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by these technological advancements.

Increased Investment in Renewable Energy Infrastructure

The Encapsulant Material for PV Module Market benefits from increased investment in renewable energy infrastructure. Governments and private entities are channeling substantial funds into solar energy projects, which in turn boosts the demand for photovoltaic modules and their components, including encapsulant materials. Recent reports indicate that investments in solar energy infrastructure are expected to exceed $200 billion by 2025. This influx of capital is likely to stimulate innovation and production in the encapsulant materials sector, as manufacturers strive to meet the growing demand for high-performance solar modules.