Emergence of Edge Computing

The Embedded Intelligent System Market is being transformed by the emergence of edge computing. This technology allows data processing to occur closer to the source, reducing latency and improving response times for embedded systems. As industries increasingly require real-time data analysis and decision-making capabilities, edge computing is becoming a critical component of embedded intelligent systems. Market forecasts suggest that the edge computing market will experience substantial growth, potentially exceeding several billion dollars in the next few years. This trend indicates a shift towards more decentralized computing architectures, which could enhance the performance and capabilities of embedded intelligent systems.

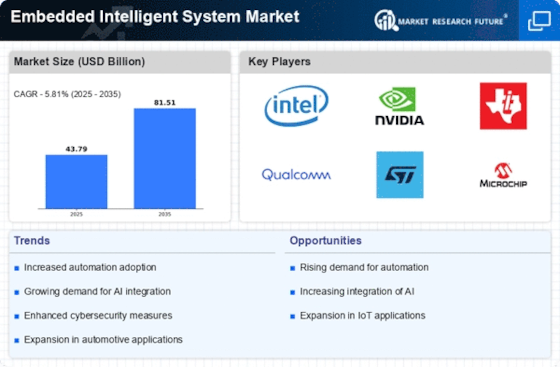

Increased Demand for Automation

The Embedded Intelligent System Market is witnessing an increased demand for automation across various sectors. Industries such as manufacturing, healthcare, and transportation are increasingly adopting embedded intelligent systems to streamline operations and enhance productivity. According to recent data, the automation market is expected to reach a valuation of several billion dollars, indicating a robust growth trajectory. This trend is driven by the need for improved efficiency, reduced operational costs, and enhanced safety measures. As organizations seek to optimize their processes, the reliance on embedded intelligent systems is likely to intensify, further propelling market growth.

Advancements in Sensor Technology

The Embedded Intelligent System Market is experiencing a notable surge due to advancements in sensor technology. These innovations enable systems to gather and process data more efficiently, enhancing their functionality. For instance, the integration of high-precision sensors allows for real-time monitoring and control in various applications, from industrial automation to smart homes. The market for sensors is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is likely to drive demand for embedded intelligent systems that can leverage these advanced sensors, thereby improving decision-making processes and operational efficiency.

Growing Adoption of Smart Devices

The Embedded Intelligent System Market is significantly influenced by the growing adoption of smart devices. As consumers increasingly embrace smart technologies, the demand for embedded systems that can support these devices is on the rise. The proliferation of smartphones, wearables, and smart home devices is creating a substantial market for embedded intelligent systems. Recent statistics indicate that the smart device market is projected to grow at a compound annual growth rate of over 15%. This trend suggests that manufacturers will need to invest in advanced embedded systems to meet consumer expectations for connectivity and functionality, thereby driving market expansion.

Regulatory Support for Smart Technologies

The Embedded Intelligent System Market benefits from regulatory support aimed at promoting smart technologies. Governments worldwide are implementing policies that encourage the development and adoption of intelligent systems across various sectors. This regulatory environment fosters innovation and investment in embedded systems, as companies seek to comply with new standards and leverage incentives. For example, initiatives aimed at enhancing energy efficiency and reducing carbon emissions are likely to drive the adoption of embedded intelligent systems in sectors such as transportation and manufacturing. This supportive framework may lead to increased market opportunities and growth in the coming years.