Emergence of 5G Technology

The rollout of 5G technology is poised to transform the Embedded Computing System Market significantly. With its promise of ultra-fast data transfer and low latency, 5G enables new applications and services that require robust embedded computing capabilities. Industries such as automotive, healthcare, and telecommunications are likely to leverage 5G to enhance connectivity and performance. The market for 5G-enabled devices is projected to grow exponentially, with estimates suggesting a compound annual growth rate of over 30% in the coming years. This technological advancement not only facilitates the development of smarter applications but also drives the demand for advanced embedded systems that can support 5G functionalities. As a result, the Embedded Computing System Market is expected to benefit from the widespread adoption of 5G technology.

Expansion of Smart Devices

The proliferation of smart devices is a significant catalyst for the Embedded Computing System Market. As consumers increasingly adopt smart home technologies, wearables, and connected appliances, the demand for embedded systems that enable these devices continues to rise. Market Research Future indicates that the smart device market is expected to reach a valuation of over 500 billion dollars by 2026, creating substantial opportunities for embedded computing solutions. These systems are essential for processing data, managing connectivity, and ensuring user interaction in smart devices. As the trend towards smart living accelerates, the Embedded Computing System Market is poised for growth, driven by the need for innovative and efficient embedded solutions.

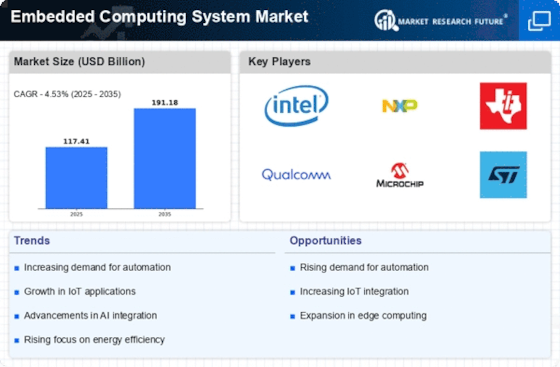

Rising Demand for Automation

The Embedded Computing System Market experiences a notable surge in demand for automation across various sectors, including manufacturing, healthcare, and transportation. Automation enhances efficiency and reduces operational costs, prompting industries to adopt embedded systems for real-time data processing and control. According to recent data, the automation sector is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This trend indicates a robust market for embedded computing systems, as they serve as the backbone for automated solutions, enabling seamless integration and functionality. As industries increasingly rely on automated processes, the Embedded Computing System Market is likely to witness substantial growth, driven by the need for advanced computing capabilities that support automation initiatives.

Advancements in Edge Computing

The Embedded Computing System Market is significantly influenced by advancements in edge computing technologies. Edge computing allows data processing to occur closer to the source, reducing latency and bandwidth usage. This shift is particularly relevant for applications in IoT, where real-time data analysis is crucial. The market for edge computing is expected to expand rapidly, with estimates suggesting a growth rate of around 25% annually. As organizations seek to enhance their operational efficiency and responsiveness, embedded computing systems that facilitate edge computing will become increasingly vital. This trend not only supports the proliferation of IoT devices but also enhances the overall performance of embedded systems, thereby driving growth in the Embedded Computing System Market.

Increased Focus on Energy Efficiency

Energy efficiency has emerged as a critical driver in the Embedded Computing System Market. With rising energy costs and environmental concerns, industries are prioritizing energy-efficient solutions. Embedded systems are being designed to consume less power while maintaining high performance, which is essential for applications in sectors such as automotive and consumer electronics. Recent studies indicate that energy-efficient embedded systems can reduce energy consumption by up to 30%, making them attractive to manufacturers. This focus on sustainability not only aligns with regulatory requirements but also appeals to environmentally conscious consumers. Consequently, the demand for energy-efficient embedded computing systems is likely to propel growth within the Embedded Computing System Market.