Rising Demand for Smart Devices

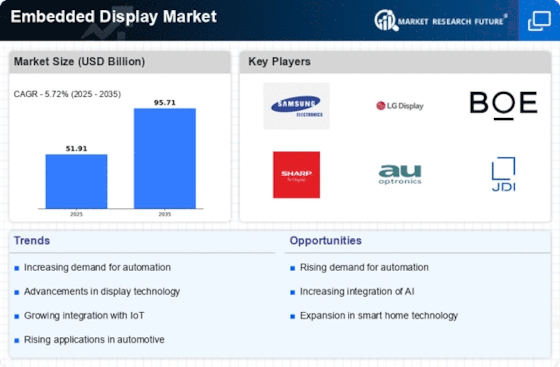

The increasing proliferation of smart devices is a primary driver for the Embedded Display Market. As consumers seek more interactive and user-friendly interfaces, manufacturers are integrating embedded displays into a variety of products, including smartphones, tablets, and wearables. According to recent data, the market for smart devices is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend indicates a robust demand for embedded displays, as they enhance the functionality and appeal of these devices. Furthermore, the integration of advanced display technologies, such as OLED and LCD, is likely to elevate user experiences, thereby propelling the Embedded Display Market forward. The convergence of technology and consumer preferences suggests that the market will continue to expand as innovation drives new applications.

Growth in Healthcare Applications

The healthcare sector is increasingly adopting embedded displays for various applications, driving growth in the Embedded Display Market. Medical devices, such as diagnostic equipment and patient monitoring systems, are integrating advanced display technologies to improve usability and patient outcomes. Recent data suggests that the healthcare display market is projected to grow at a rate of 8% annually, reflecting the rising need for efficient and accurate medical devices. Embedded displays facilitate real-time data visualization, which is crucial for healthcare professionals in making informed decisions. As the demand for telemedicine and remote monitoring continues to rise, the Embedded Display Market is likely to expand further, with innovations in display technology enhancing the functionality and reliability of medical devices.

Advancements in Automotive Displays

The automotive sector is witnessing a transformative shift, with embedded displays becoming increasingly prevalent in vehicles. The Embedded Display Market is significantly influenced by the rising adoption of digital dashboards, infotainment systems, and heads-up displays. Recent statistics indicate that the automotive display market is expected to reach a valuation of over 30 billion dollars by 2026. This growth is attributed to the demand for enhanced driver and passenger experiences, as well as the integration of advanced safety features. As automakers prioritize connectivity and user engagement, the Embedded Display Market is likely to benefit from innovations in display technology, such as curved and flexible screens. This trend not only enhances the aesthetic appeal of vehicles but also improves functionality, suggesting a promising future for embedded displays in the automotive domain.

Emergence of Internet of Things (IoT)

The Internet of Things (IoT) is reshaping various industries, and its impact on the Embedded Display Market is profound. As more devices become interconnected, the need for embedded displays in IoT applications is growing. These displays serve as critical interfaces for smart home devices, industrial automation, and smart city solutions. Market analysis indicates that the IoT market is expected to surpass 1 trillion dollars by 2025, which will likely drive demand for embedded displays. The integration of displays in IoT devices enhances user interaction and provides essential data visualization, making them indispensable in modern applications. As the IoT ecosystem expands, the Embedded Display Market is poised for significant growth, driven by the need for innovative display solutions that cater to diverse applications.

Focus on Energy Efficiency and Sustainability

The emphasis on energy efficiency and sustainability is becoming increasingly relevant in the Embedded Display Market. Manufacturers are prioritizing the development of energy-efficient display technologies, such as low-power LCDs and OLEDs, to meet consumer demand for environmentally friendly products. Recent studies indicate that energy-efficient displays can reduce power consumption by up to 50% compared to traditional technologies. This shift not only aligns with global sustainability goals but also appeals to environmentally conscious consumers. As regulations regarding energy consumption become more stringent, the Embedded Display Market is likely to see a surge in demand for energy-efficient solutions. The focus on sustainability may also drive innovation in materials and manufacturing processes, further enhancing the market's growth potential.