Advancements in Technology

Technological advancements play a pivotal role in shaping the Embedded Analytics Market. Innovations in data processing, machine learning, and cloud computing are enabling organizations to embed sophisticated analytics capabilities into their applications. The proliferation of Internet of Things (IoT) devices is also contributing to this trend, as these devices generate vast amounts of data that require effective analysis. As a result, the market is witnessing a shift towards more intuitive and user-friendly analytics solutions. It is estimated that by 2026, the market could reach a valuation exceeding 30 billion, reflecting the growing importance of technology in driving the Embedded Analytics Market.

Increased Focus on Business Intelligence

The Embedded Analytics Market is benefiting from an increased focus on business intelligence (BI) across various sectors. Organizations are investing in BI tools that provide actionable insights, enabling them to optimize processes and enhance customer experiences. This trend is particularly evident in industries such as finance, healthcare, and retail, where data-driven strategies are crucial for success. The market for BI solutions is expected to expand significantly, with projections indicating a potential growth rate of around 15% annually. This emphasis on BI is likely to propel the Embedded Analytics Market, as companies seek to integrate analytics seamlessly into their operational frameworks.

Growing Adoption of Cloud-Based Analytics

The shift towards cloud-based solutions is a key driver of the Embedded Analytics Market. Organizations are increasingly adopting cloud-based analytics platforms due to their scalability, flexibility, and cost-effectiveness. This transition allows businesses to access advanced analytics tools without the need for extensive on-premises infrastructure. As cloud adoption continues to rise, it is anticipated that the Embedded Analytics Market will experience substantial growth, with cloud-based analytics expected to account for a significant portion of the market share. By 2025, cloud-based analytics could represent over 60% of the total analytics market, underscoring the transformative impact of cloud technology on the Embedded Analytics Market.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are increasingly influencing the Embedded Analytics Market. Organizations are under pressure to adhere to various regulations regarding data privacy and security, which necessitates the implementation of robust analytics solutions. These solutions not only help in compliance but also enhance data quality and integrity. As businesses navigate complex regulatory landscapes, the demand for embedded analytics that supports compliance efforts is likely to grow. It is estimated that the market for compliance-related analytics tools could see a growth rate of around 12% annually, reflecting the critical role of regulatory considerations in shaping the Embedded Analytics Market.

Rising Demand for Data-Driven Decision Making

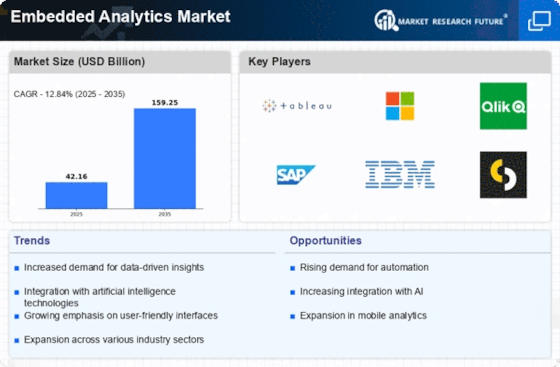

The Embedded Analytics Market is experiencing a notable surge in demand for data-driven decision making. Organizations are increasingly recognizing the value of integrating analytics directly into their applications to enhance operational efficiency and strategic planning. According to recent estimates, the market is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is largely attributed to the need for real-time insights that empower businesses to make informed decisions swiftly. As companies strive to remain competitive, the integration of analytics into everyday workflows is becoming essential, thereby driving the Embedded Analytics Market forward.