Growing Focus on Sustainability

The increasing emphasis on sustainability is a significant driver for the Electric Vehicle Reducer Market. As environmental concerns gain prominence, consumers and manufacturers alike are prioritizing eco-friendly solutions. The electric vehicle sector is inherently aligned with sustainability goals, and the demand for reducers that minimize energy consumption and reduce carbon footprints is on the rise. In 2025, the market is expected to see a growing preference for reducers that utilize sustainable materials and manufacturing processes. This shift not only enhances the appeal of electric vehicles but also positions the Electric Vehicle Reducer Market as a key player in the broader sustainability movement, attracting investments and fostering innovation.

Government Incentives and Policies

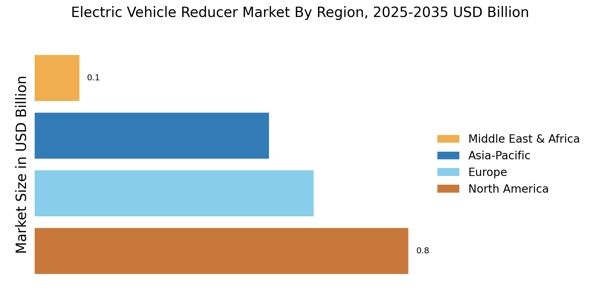

Government initiatives aimed at promoting electric vehicle adoption significantly influence the Electric Vehicle Reducer Market. Various countries have implemented policies that provide financial incentives for electric vehicle purchases, such as tax credits and rebates. These measures encourage consumers to opt for electric vehicles, thereby increasing the demand for associated components, including reducers. For instance, in 2025, several regions are expected to enhance their support for electric mobility through subsidies and infrastructure development. This supportive regulatory environment fosters growth in the Electric Vehicle Reducer Market, as manufacturers respond to the heightened demand for efficient reducers that comply with evolving standards.

Rising Demand for Electric Vehicles

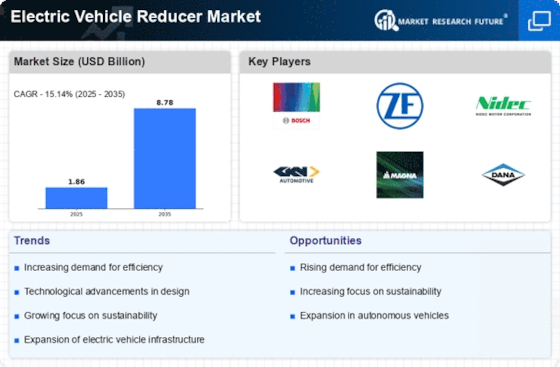

The increasing consumer preference for electric vehicles is a primary driver for the Electric Vehicle Reducer Market. As more individuals and businesses transition to electric mobility, the demand for efficient and reliable reducers rises. In 2025, the electric vehicle sales are projected to reach approximately 10 million units, indicating a robust growth trajectory. This surge in electric vehicle adoption necessitates advanced reducer technologies that enhance performance and efficiency. Consequently, manufacturers are focusing on developing innovative reducer designs that cater to the evolving needs of electric vehicles. The Electric Vehicle Reducer Market is thus positioned to benefit from this trend, as it aligns with the broader shift towards sustainable transportation solutions.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a crucial factor influencing the Electric Vehicle Reducer Market. As more charging stations become available, consumer confidence in electric vehicles increases, leading to higher adoption rates. In 2025, the number of public charging stations is projected to grow significantly, facilitating the use of electric vehicles across various regions. This growth in infrastructure supports the demand for electric vehicles, which in turn drives the need for efficient reducers. Manufacturers in the Electric Vehicle Reducer Market are likely to capitalize on this trend by developing products that enhance the overall performance of electric vehicles, ensuring they meet the expectations of an expanding user base.

Technological Innovations in Reducer Efficiency

Technological advancements in reducer efficiency are pivotal for the Electric Vehicle Reducer Market. Innovations such as improved gear designs, lightweight materials, and advanced manufacturing techniques contribute to enhanced performance and energy efficiency. In 2025, the market is witnessing a shift towards high-performance reducers that can operate at lower energy losses, thereby extending the range of electric vehicles. This trend is driven by the need for electric vehicles to compete with traditional combustion engines in terms of performance. As manufacturers invest in research and development, the Electric Vehicle Reducer Market is likely to experience a surge in demand for cutting-edge reducer technologies that meet the expectations of consumers and regulatory bodies alike.