Electric Vehicle Motor Size

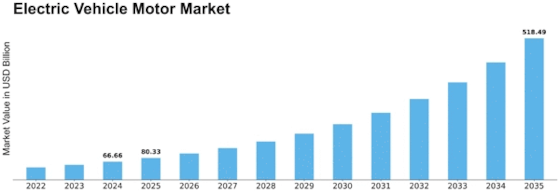

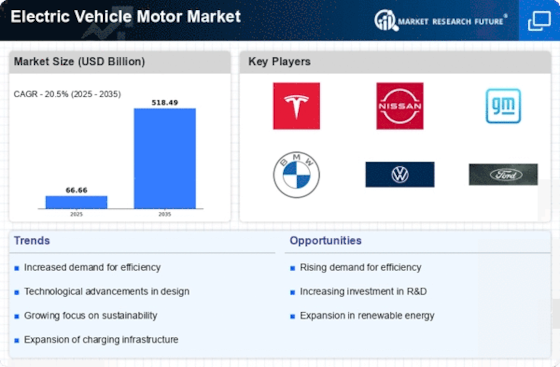

Electric Vehicle Motor Market Growth Projections and Opportunities

The market for Electric Vehicle (EV) Motors is affected by different things. These factors change the way it works, influencing both how many of these motors are made and sold with electric cars. The main cause of the market is a worldwide effort to make transportation more environmentally friendly. People are starting to worry about pollution and climate change. Because of this, governments and those who buy things like cars want more electric vehicles instead of regular old engine powered ones because they're cleaner for the environment. The world is moving towards eco-friendly transportation, which means more demand for EV engines. They are very important in changing to a future with less pollution from cars and trucks.

Policies by the government and rewards have a big part in how the EV Motor market grows. Many governments around the world are making rules and giving bonuses to encourage people to buy electric cars. This includes helping out with money, tax breaks and rules that encourage car makers to make electric cars and people buying them. Moreover, efforts to increase places for charging help the whole market change. They affect both making and using electric motors in cars.

Technology improvements are important things in the electric motor business for cars. Changes in how engines are made, what they're built from and the ways we make them help EV motors work better, use less energy and save money. Improvements in batteries, power controls and systems make electric cars work better and go farther. As the market for electric cars grows, those who make motors must keep up with new technology. They need to provide top-notch solutions that meet more and more requests from car makers.

The cost of batteries and the total price for electric cars make a big difference in the EV Motor market. The falling price of lithium-ion batteries, which are a main part of electric cars, helps make EVs cheaper. This then drives more people to want them and raises the demand for motors in these vehicles. Government help and payments also change how money is spent on electric cars. This makes them more wanted by people, which helps the market to grow.

The EV Motor market is greatly affected by global trends in the car industry and choices made by buyers. As more people care about being environmentally friendly and look for ways to save energy, they want electric cars. This is making their popularity grow too. Car companies are answering these changes by giving us more electric cars, which in turn makes people want better and sure EV motors.

Infrastructure development, specifically the expansion of charging networks, contributes to the growth of the EV Motor market. The availability of charging infrastructure is a critical factor influencing consumer confidence in electric vehicles. As governments and private entities invest in the development of charging stations, it enhances the feasibility of owning and operating electric vehicles, ultimately boosting the demand for EV motors. The progress in charging infrastructure alleviates range anxiety and supports the broader adoption of electric mobility.

Leave a Comment