Top Industry Leaders in the Electric Vehicle Motor Market

Dynamics of the Electric Vehicle Motor Market Key Players, Strategies, and Emerging Trends

Dynamics of the Electric Vehicle Motor Market Key Players, Strategies, and Emerging Trends

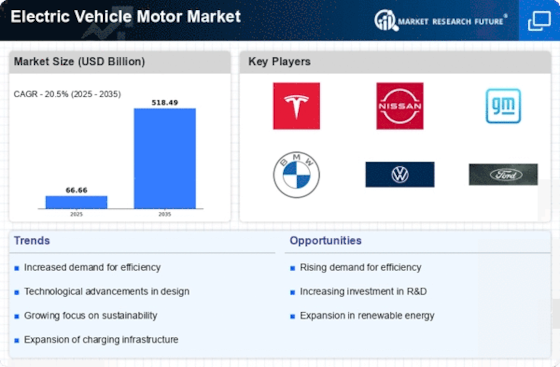

The Electric Vehicle (EV) motor market is experiencing rapid growth within the automotive industry, driven by the global shift towards sustainable transportation. This market is characterized by intense competition, with both established players and innovative startups vying for market share.

Electric Vehicle Motor Key Players and Strategic Approaches:

Leading players in the EV motor market include Continental AG (Germany), Hitachi Automotive Systems Ltd. (Japan), Tesla Inc. (US.), BYD Auto Co. Ltd. (China), Denso Corporation (Japan), Metric Mind Corporation (US.), Mitsubishi Electric Corporation (Japan), Allied Motion Technologies Inc. (US.), Robert Bosch GmbH (Germany), Siemens AG (Germany), among others. These players adopt distinct strategies:

- Global Giants: Established players like Bosch, Denso, Continental, and Nidec leverage diverse product portfolios, strong manufacturing capabilities, and established relationships with automakers to maintain dominant positions. They prioritize research and development (R&D) to enhance motor efficiency, power density, and cost-effectiveness.

- EV-Focused Companies: Companies like Nidec's EV division, Tesla, and BYD concentrate solely on EV technologies, allowing them to tailor products specifically to EV requirements and respond rapidly to market trends. They adopt vertically integrated models to control the entire supply chain, from motor design to production.

- Emerging Startups: New entrants like Arrival, REE Automotive, and REE Automotive bring fresh perspectives and innovative technologies to the market. They focus on developing next-generation motors with higher efficiency, lower weight, and unique functionalities. Additionally, they prioritize collaborations with established automakers to gain market access and accelerate growth.

Market Share Analysis Factors:

Several factors influence market share dynamics in the EV motor market:

- Motor Type: Market share for different motor types, such as AC induction motors, brushless DC motors, and permanent magnet synchronous motors, varies based on their performance characteristics and overall cost.

- Power Rating: The demand for different power-rated motors is determined by vehicle type and performance requirements. Higher power ratings are preferred for high-performance vehicles and heavy-duty applications.

- Geographical Distribution: Market share varies significantly across different geographical regions due to variations in government incentives, EV adoption rates, and local manufacturing capabilities.

- Price Competitiveness: Cost is crucial for price-sensitive customers. Companies adopt cost-reduction strategies, such as optimizing manufacturing processes and developing standardized motor designs, to increase competitiveness.

New and Emerging Trends:

Several trends are shaping the competitive landscape of the EV motor market:

- Increased Focus on Efficiency and Power Density: Companies innovate continuously to improve the efficiency and power density of their motors, leading to longer driving ranges for EVs and allowing more compact and lightweight motor designs.

- Development of Next-Generation Motor Technologies: Technologies like silicon carbide (SiC) power electronics and integrated motor-drive systems are being explored to enhance motor performance and efficiency.

- Shift towards Modular and Scalable Designs: Manufacturers are moving towards modular and scalable motor designs to cater to the diverse range of EV models and meet the growing demand for customization.

- Integration of AI and ML: AI and ML are employed to optimize motor control systems, improve predictive maintenance, and personalize the driving experience.

- Focus on Sustainability and Ethical Sourcing: Companies increasingly focus on using sustainable materials and ethically sourcing components to align with broader environmental and social responsibility initiatives.

Competitive Scenario:

The EV motor market is highly competitive, with both established players and new entrants vying for market share. The competitive landscape is expected to intensify further as EV adoption continues to accelerate globally.

To stay competitive, companies need to continuously innovate, optimize manufacturing processes, and adopt cost-effective strategies. Additionally, leveraging strengths and collaborating with other industry players are crucial for gaining a competitive edge.

The future of the EV motor market looks promising, with significant growth expected in the coming years. This growth will be fueled by increasing government support, technological advancements, and rising consumer demand for sustainable transportation solutions. Companies that can adapt to the rapidly evolving market landscape and implement effective strategies will be well-positioned to succeed in this dynamic and exciting industry.

Industry Developments and Latest Updates:

Hitachi Automotive Systems Ltd. (Japan):

- September 2023: Unveiled a new high-performance electric motor with an integrated inverter, offering increased efficiency and a compact design. (Source: Continental Press Release)

Tesla Inc. (US.):

- December 2023: Opened its first dedicated electric vehicle motor factory in Austin, Texas. (Source: Tesla Blog)

BYD Auto Co. Ltd. (China):

- September 2023: Launched its Blade Battery technology for electric vehicles, offering improved safety and range. (Source: BYD Auto Website)

Denso Corporation (Japan):

- August 2023: Supplied its first silicon carbide inverter for electric vehicles, enabling higher efficiency and performance. (Source: Denso Press Release)