Growing Environmental Awareness

Growing environmental awareness is significantly influencing the Electric Vehicle Charging Equipment Market. As consumers become more conscious of their carbon footprint, the shift towards electric vehicles is gaining momentum. In 2025, a notable percentage of consumers are expected to prioritize sustainability in their purchasing decisions, further driving the demand for electric vehicles and, by extension, the need for charging infrastructure. This heightened awareness is prompting manufacturers and service providers within the Electric Vehicle Charging Equipment Market to develop solutions that align with eco-friendly practices, thereby fostering a more sustainable future.

Government Incentives and Policies

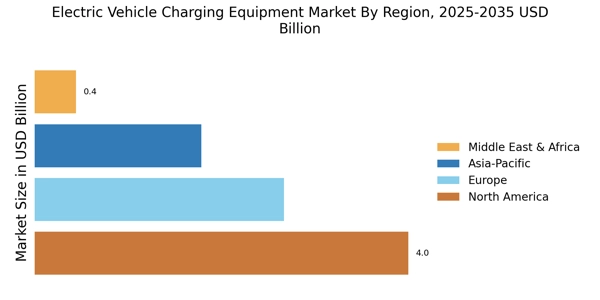

The Electric Vehicle Charging Equipment Market is experiencing a surge in growth due to favorable government incentives and policies aimed at promoting electric vehicle adoption. Various countries have implemented tax credits, rebates, and grants to encourage consumers and businesses to invest in electric vehicles and their charging infrastructure. For instance, in 2025, several regions have allocated substantial budgets to enhance charging networks, which is expected to increase the number of charging stations significantly. This supportive regulatory environment not only boosts consumer confidence but also stimulates investments in the Electric Vehicle Charging Equipment Market, leading to a more robust infrastructure that can accommodate the growing number of electric vehicles.

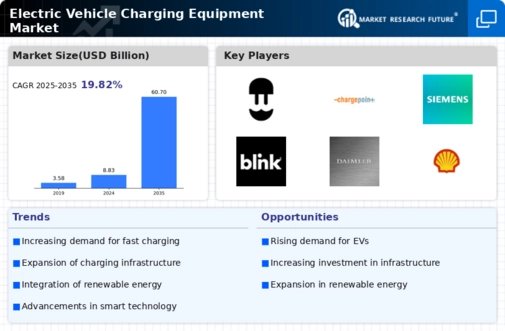

Rising Demand for Electric Vehicles

The Electric Vehicle Charging Equipment Market is poised for expansion as the demand for electric vehicles continues to rise. With an increasing number of consumers opting for electric vehicles due to environmental concerns and lower operating costs, the need for efficient charging solutions becomes paramount. In 2025, it is estimated that electric vehicle sales will account for a substantial percentage of total vehicle sales, necessitating a corresponding increase in charging infrastructure. This growing consumer preference is driving manufacturers to innovate and enhance their offerings in the Electric Vehicle Charging Equipment Market, ensuring that charging solutions are accessible, efficient, and user-friendly.

Increased Investment in Charging Infrastructure

Investment in charging infrastructure is a key driver for the Electric Vehicle Charging Equipment Market. As electric vehicle adoption accelerates, stakeholders, including private companies and governments, are recognizing the necessity of a robust charging network. In 2025, it is projected that investments in charging infrastructure will reach unprecedented levels, facilitating the installation of charging stations in urban and rural areas alike. This expansion is crucial for alleviating range anxiety among electric vehicle users and is likely to enhance the overall appeal of electric vehicles. Consequently, the Electric Vehicle Charging Equipment Market stands to benefit from this influx of capital and resources.

Technological Advancements in Charging Solutions

Technological advancements are playing a crucial role in shaping the Electric Vehicle Charging Equipment Market. Innovations such as fast charging technology, wireless charging, and smart charging solutions are enhancing the efficiency and convenience of charging electric vehicles. In 2025, the introduction of ultra-fast charging stations is expected to reduce charging times significantly, making electric vehicles more appealing to consumers. These advancements not only improve user experience but also contribute to the overall growth of the Electric Vehicle Charging Equipment Market by addressing one of the primary concerns of potential electric vehicle owners: charging time.