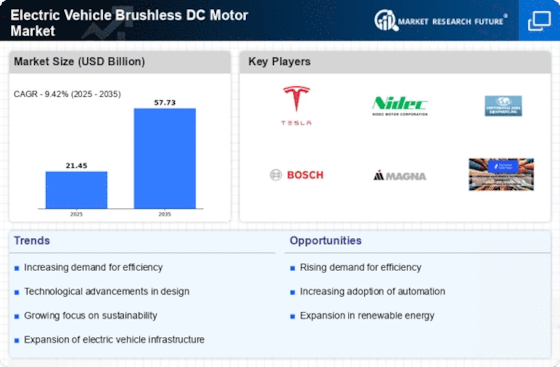

Growing Focus on Energy Efficiency

The emphasis on energy efficiency in the automotive sector is a significant driver for the Electric Vehicle Brushless DC Motor Market. As consumers and manufacturers alike prioritize energy conservation, the demand for high-efficiency motors is on the rise. Brushless DC motors are known for their superior efficiency compared to traditional brushed motors, making them an attractive choice for electric vehicles. This focus on energy efficiency aligns with global sustainability goals, prompting manufacturers to invest in advanced motor technologies that minimize energy consumption. As a result, the Electric Vehicle Brushless DC Motor Market is likely to experience robust growth, driven by the increasing need for energy-efficient solutions in the evolving automotive landscape.

Government Regulations and Policies

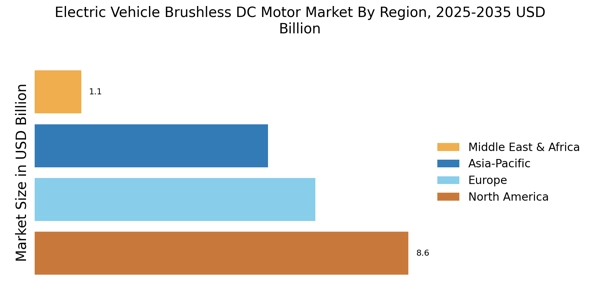

Government regulations aimed at reducing carbon emissions and promoting electric mobility are pivotal in shaping the Electric Vehicle Brushless DC Motor Market. Many countries have implemented stringent emission standards, encouraging automakers to transition to electric powertrains. Additionally, various incentives, such as tax rebates and subsidies for EV purchases, further stimulate market growth. For instance, certain regions have set ambitious targets for EV adoption, aiming for a significant percentage of new vehicle sales to be electric by 2030. These regulatory frameworks create a conducive environment for the Electric Vehicle Brushless DC Motor Market, as manufacturers align their strategies to comply with these mandates while capitalizing on the growing demand for electric vehicles.

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Electric Vehicle Brushless DC Motor Market. As environmental concerns gain prominence, more consumers are opting for EVs over traditional internal combustion engine vehicles. This shift is reflected in the sales figures, with EV sales witnessing a substantial rise, accounting for approximately 10% of total vehicle sales in recent years. The demand for efficient and high-performance motors, such as brushless DC motors, is expected to surge as manufacturers strive to enhance vehicle performance and range. Consequently, the Electric Vehicle Brushless DC Motor Market is poised for growth, driven by the need for advanced motor technologies that align with consumer expectations for sustainability and efficiency.

Increased Investment in EV Infrastructure

The expansion of electric vehicle charging infrastructure is a crucial driver for the Electric Vehicle Brushless DC Motor Market. As more charging stations become available, consumer confidence in EVs is likely to increase, leading to higher adoption rates. Investments in fast-charging technologies and widespread charging networks are essential for addressing range anxiety among potential EV buyers. This infrastructure development not only supports the growth of the electric vehicle market but also enhances the demand for efficient brushless DC motors, which are integral to the performance of electric vehicles. Consequently, the Electric Vehicle Brushless DC Motor Market stands to benefit from these infrastructural advancements, as they facilitate a smoother transition to electric mobility.

Technological Innovations in Motor Design

Technological advancements in motor design and manufacturing processes are significantly influencing the Electric Vehicle Brushless DC Motor Market. Innovations such as improved magnetic materials and advanced control algorithms enhance the efficiency and performance of brushless DC motors. These developments not only increase the power density of motors but also reduce their weight, contributing to overall vehicle efficiency. The market is witnessing a trend towards integrating smart technologies, enabling better energy management and performance monitoring. As manufacturers adopt these innovations, the Electric Vehicle Brushless DC Motor Market is likely to experience accelerated growth, driven by the demand for cutting-edge motor solutions that meet the evolving needs of the automotive sector.