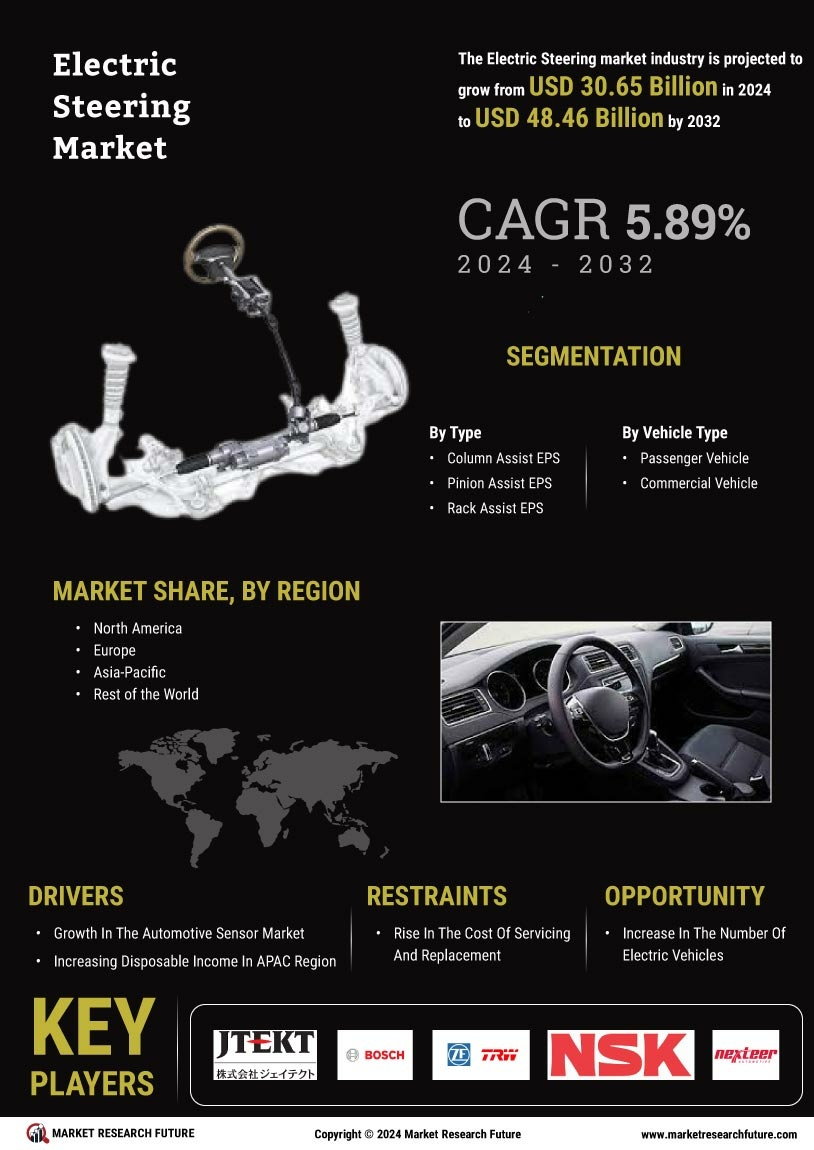

Focus on Fuel Efficiency and Performance

The Electric Steering Market is closely linked to the growing emphasis on fuel efficiency and overall vehicle performance. Electric steering systems contribute to weight reduction and improved energy efficiency, which are critical factors in enhancing vehicle performance. As consumers become more environmentally conscious, the demand for fuel-efficient vehicles is rising. Market analysis reveals that vehicles equipped with electric steering systems can achieve better fuel economy compared to traditional hydraulic systems. This trend is prompting automakers to adopt electric steering technologies as part of their strategies to meet consumer expectations and regulatory standards. Consequently, the Electric Steering Market is likely to experience sustained growth as manufacturers prioritize performance and efficiency in their vehicle designs.

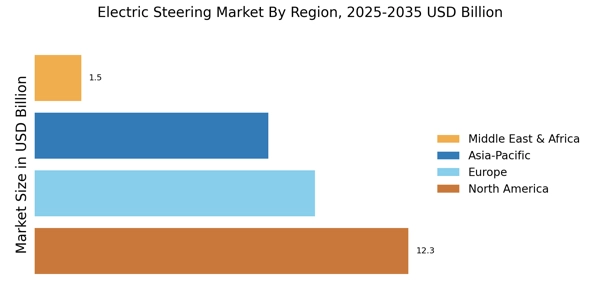

Regulatory Support for Electric Vehicles

The Electric Steering Market is benefiting from regulatory support aimed at promoting electric vehicles (EVs) and reducing carbon emissions. Governments worldwide are implementing stringent regulations that encourage the adoption of electric steering systems as part of broader initiatives to enhance vehicle efficiency. For instance, incentives for EV purchases and mandates for reduced emissions are driving automakers to incorporate electric steering technologies. Market data suggests that regions with robust regulatory frameworks are witnessing a faster transition to electric steering systems, as manufacturers align their product offerings with compliance requirements. This regulatory environment is likely to bolster the Electric Steering Market, fostering innovation and investment in electric steering technologies.

Consumer Demand for Enhanced Driving Experience

The Electric Steering Market is significantly influenced by consumer demand for an enhanced driving experience. Modern consumers are increasingly seeking vehicles that offer superior comfort, responsiveness, and control. Electric steering systems provide a customizable driving experience, allowing drivers to adjust steering sensitivity and feedback according to their preferences. This trend is reflected in market data, which indicates that vehicles equipped with electric steering systems are preferred by a substantial percentage of consumers. As automakers strive to meet these evolving consumer expectations, the Electric Steering Market is poised for growth, with manufacturers focusing on integrating advanced features that cater to individual driving styles.

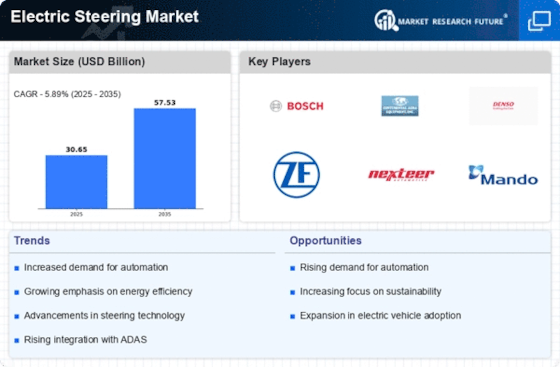

Technological Advancements in Electric Steering

The Electric Steering Market is experiencing rapid technological advancements that enhance vehicle performance and safety. Innovations such as steer-by-wire systems and advanced sensor integration are becoming increasingly prevalent. These technologies not only improve steering precision but also contribute to overall vehicle dynamics. According to recent data, the adoption of electric steering systems is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is driven by the increasing demand for advanced driver assistance systems (ADAS) and autonomous vehicles, which rely heavily on sophisticated steering technologies. As manufacturers invest in research and development, the Electric Steering Market is likely to witness a surge in new product offerings, further driving market expansion.

Integration of Electric Steering in Autonomous Vehicles

The Electric Steering Market is increasingly intertwined with the development of autonomous vehicles. As the automotive industry moves towards automation, electric steering systems are becoming essential components that facilitate precise control and maneuverability. These systems enable seamless communication between the vehicle's control units and steering mechanisms, which is crucial for the safe operation of autonomous vehicles. Market forecasts indicate that the demand for electric steering systems in autonomous vehicles will rise significantly, driven by advancements in artificial intelligence and machine learning. This integration not only enhances the functionality of autonomous vehicles but also positions the Electric Steering Market at the forefront of automotive innovation.