Increasing Urbanization

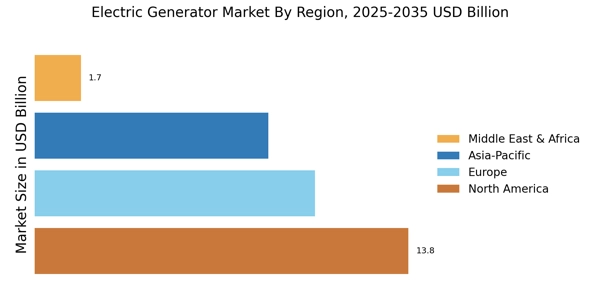

The Electric Generator Market is experiencing a notable surge due to the rapid urbanization occurring in various regions. As populations migrate towards urban centers, the demand for reliable power sources escalates. Urban areas often face challenges related to power supply, leading to an increased reliance on electric generators for both residential and commercial applications. According to recent data, urbanization rates are projected to reach 68% by 2050, which could significantly boost the electric generator market. This trend indicates a potential for growth in generator sales, particularly in densely populated cities where power outages can disrupt daily life. Consequently, manufacturers are likely to focus on developing compact and efficient generators tailored for urban environments, thereby enhancing their market presence.

Government Initiatives and Incentives

The Electric Generator Market is benefiting from various government initiatives and incentives aimed at promoting energy independence and sustainability. Many governments are implementing policies that encourage the use of electric generators, particularly those that utilize renewable energy sources. Incentives such as tax credits and rebates for solar-powered generators are becoming increasingly common, stimulating market growth. For instance, certain regions have reported a 25% increase in sales of solar generators due to favorable government policies. These initiatives not only support the transition to cleaner energy but also create a favorable environment for manufacturers to innovate and expand their product lines. As governments continue to prioritize energy solutions, the electric generator market is likely to experience sustained growth.

Rising Frequency of Natural Disasters

The Electric Generator Market is witnessing a surge in demand driven by the increasing frequency of natural disasters. Events such as hurricanes, floods, and wildfires have highlighted the necessity for reliable backup power solutions. As communities face prolonged power outages due to these disasters, the reliance on electric generators becomes paramount. Recent statistics indicate that the number of natural disasters has risen significantly, with a reported increase of 40% over the last decade. This trend suggests a growing market for portable and standby generators, as individuals and businesses seek to ensure continuity of operations during emergencies. Consequently, manufacturers are likely to enhance their product offerings to meet the evolving needs of consumers in disaster-prone areas.

Expansion of Industrial and Commercial Sectors

The Electric Generator Market is experiencing growth fueled by the expansion of industrial and commercial sectors. As industries scale operations and new businesses emerge, the demand for reliable power sources becomes critical. Manufacturing facilities, data centers, and retail establishments require uninterrupted power supply to maintain productivity and service delivery. Recent data suggests that the industrial sector is projected to grow at a rate of 5% annually, which could significantly impact the electric generator market. This growth indicates a potential increase in the adoption of generators for both primary and backup power applications. Manufacturers are likely to respond by developing robust generators that cater to the specific needs of various industries, thereby enhancing their competitive edge in the market.

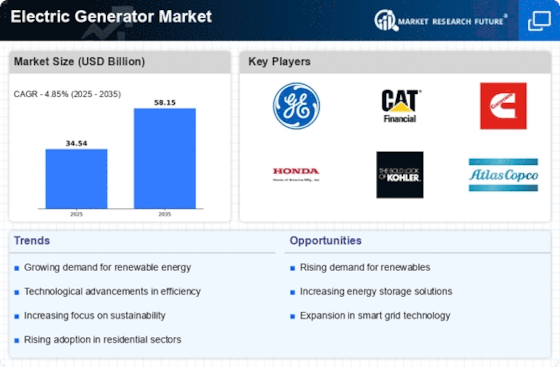

Technological Advancements in Generator Design

The Electric Generator Market is poised for growth as technological advancements in generator design continue to evolve. Innovations such as inverter technology and hybrid systems are enhancing the efficiency and performance of electric generators. These advancements not only improve fuel efficiency but also reduce emissions, aligning with global sustainability goals. The market for inverter generators, which are quieter and more portable, is expected to expand significantly, with projections indicating a compound annual growth rate of over 10% in the coming years. As consumers become more environmentally conscious, the demand for advanced generators that offer both performance and eco-friendliness is likely to increase, driving competition among manufacturers to innovate and capture market share.