Government Incentives and Regulations

The Electric Forklifts Market is significantly shaped by government incentives and regulations aimed at promoting cleaner technologies. Various governments are implementing tax credits, rebates, and grants to encourage businesses to transition from internal combustion forklifts to electric models. For instance, certain regions have introduced regulations that mandate the use of electric forklifts in specific industries, further propelling market growth. Recent statistics suggest that regions with strong government support have seen a 25% increase in electric forklift adoption over the past year. As these incentives continue to evolve, they are expected to play a crucial role in driving the Electric Forklifts Market forward.

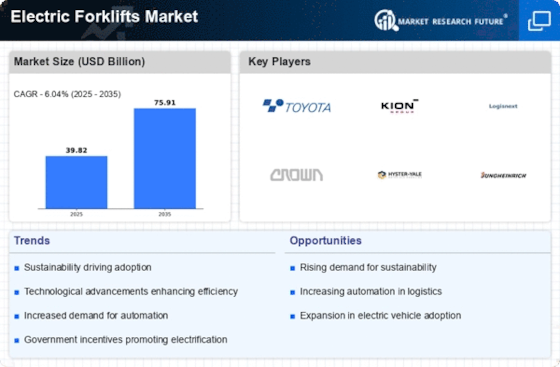

Sustainability Focus in Material Handling

The Electric Forklifts Market is increasingly influenced by a growing focus on sustainability. Companies are under pressure to reduce their carbon footprints and improve energy efficiency. Electric forklifts, which produce zero emissions during operation, align with these sustainability goals. The market data indicates that the demand for electric forklifts is expected to grow at a compound annual growth rate of over 10% in the coming years, driven by the need for greener alternatives in material handling. This shift not only helps companies comply with environmental regulations but also enhances their brand image among eco-conscious consumers. As sustainability becomes a core business strategy, the Electric Forklifts Market is likely to see a robust increase in adoption.

Cost Efficiency and Total Cost of Ownership

The Electric Forklifts Market is increasingly appealing due to the cost efficiency associated with electric forklifts. While the initial purchase price may be higher than that of traditional forklifts, the total cost of ownership tends to be lower over time. Electric forklifts require less maintenance and have lower energy costs, which can lead to substantial savings for businesses. Recent studies indicate that companies can save up to 30% on operational costs by switching to electric models. As businesses seek to optimize their budgets and improve profitability, the cost efficiency of electric forklifts is likely to drive further growth in the Electric Forklifts Market.

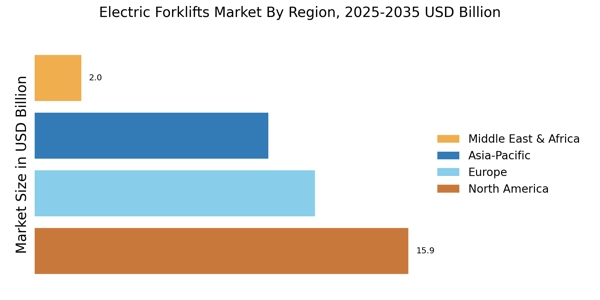

Rising Demand in E-commerce and Warehousing

The Electric Forklifts Market is witnessing a notable increase in demand driven by the rapid growth of e-commerce and warehousing sectors. As online shopping continues to expand, warehouses are under pressure to enhance their operational efficiency and throughput. Electric forklifts, known for their agility and lower operational costs, are becoming the preferred choice for many logistics companies. Market analysis indicates that the warehousing sector is projected to grow by approximately 15% annually, which will likely boost the demand for electric forklifts. This trend suggests that the Electric Forklifts Market is well-positioned to capitalize on the evolving needs of the logistics landscape.

Technological Advancements in Electric Forklifts

The Electric Forklifts Market is experiencing a surge in technological advancements that enhance operational efficiency and safety. Innovations such as advanced battery technologies, including lithium-ion batteries, are extending the operational range and reducing charging times. Furthermore, the integration of automation and IoT technologies is enabling real-time monitoring and predictive maintenance, which can significantly lower operational costs. According to recent data, the adoption of these technologies is projected to increase productivity by up to 30% in warehouse operations. As companies seek to optimize their logistics and supply chain processes, the demand for technologically advanced electric forklifts is likely to rise, driving growth in the Electric Forklifts Market.