Consumer Awareness and Education

Consumer awareness and education are pivotal in driving the Electric Engine Market. As individuals become more informed about the environmental benefits and cost savings associated with electric vehicles, their willingness to adopt this technology increases. In 2025, surveys indicate that over 70% of potential car buyers are considering electric vehicles as their next purchase. This heightened awareness is prompting manufacturers to engage in marketing campaigns that highlight the advantages of electric engines. The Electric Engine Market is thus experiencing a shift in consumer perception, with more individuals recognizing the long-term benefits of electric vehicles. As education efforts continue, it is likely that the market will see sustained growth, driven by an informed consumer base that prioritizes sustainability.

Government Incentives and Policies

Government incentives and policies play a crucial role in shaping the Electric Engine Market. Many countries are implementing favorable regulations and financial incentives to promote the adoption of electric vehicles. For instance, tax rebates, grants, and subsidies are being offered to consumers and manufacturers alike. In 2025, it is projected that government support will contribute to a 30% increase in electric vehicle sales. Such initiatives not only encourage consumers to transition to electric vehicles but also stimulate investments in electric engine technology. The Electric Engine Market is thus benefiting from a conducive regulatory environment that fosters innovation and growth, making electric engines more accessible and appealing to a broader audience.

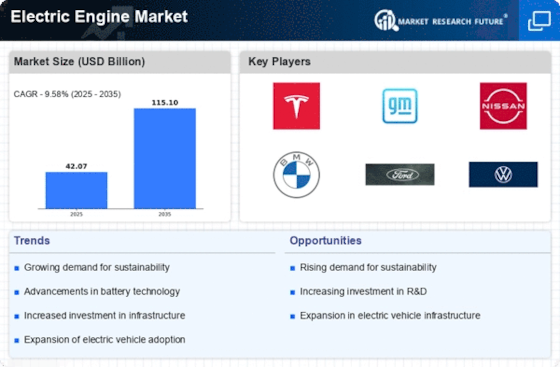

Rising Demand for Electric Vehicles

The increasing demand for electric vehicles (EVs) is a primary driver of the Electric Engine Market. As consumers become more environmentally conscious, the shift towards EVs is accelerating. In 2025, it is estimated that the sales of electric vehicles will surpass 10 million units, reflecting a compound annual growth rate of approximately 25%. This surge in demand is prompting manufacturers to invest heavily in electric engine technology, thereby enhancing the overall market landscape. The Electric Engine Market is witnessing a transformation as automakers expand their electric offerings, aiming to meet consumer preferences for sustainable transportation solutions. This trend is likely to continue, as advancements in battery technology and charging infrastructure further support the growth of electric vehicles.

Growing Infrastructure for Electric Vehicles

The expansion of infrastructure for electric vehicles is a vital driver of the Electric Engine Market. The establishment of widespread charging networks is essential for supporting the growing number of electric vehicles on the road. In 2025, it is anticipated that the number of public charging stations will increase by over 50%, facilitating easier access for consumers. This development not only alleviates range anxiety but also encourages more individuals to consider electric vehicles as a viable option. The Electric Engine Market is thus benefiting from enhanced infrastructure, which is likely to lead to increased adoption rates and further investment in electric engine technology. As infrastructure continues to grow, the market is expected to flourish, creating a more sustainable transportation ecosystem.

Technological Innovations in Electric Engines

Technological innovations are significantly influencing the Electric Engine Market. Continuous advancements in electric motor design, battery efficiency, and energy management systems are enhancing the performance and reliability of electric engines. In 2025, the introduction of solid-state batteries is expected to revolutionize the market, offering higher energy densities and faster charging times. These innovations are likely to improve the overall driving experience and reduce the total cost of ownership for consumers. As manufacturers strive to differentiate their products, the Electric Engine Market is becoming increasingly competitive, with a focus on developing cutting-edge technologies that meet the evolving needs of consumers. This trend suggests a promising future for electric engines as they become more efficient and user-friendly.