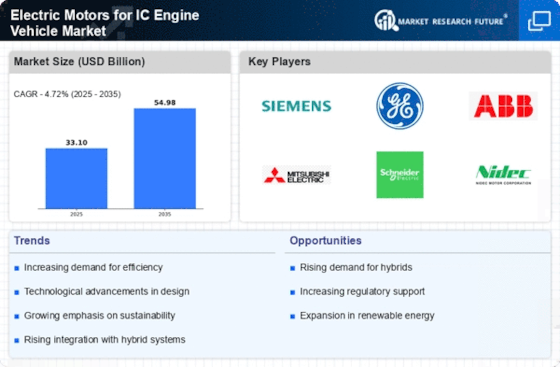

Rising Demand for Fuel Efficiency

The increasing emphasis on fuel efficiency in the automotive sector drives the Electric Motors for IC Engine Vehicle Market. Consumers and manufacturers alike are prioritizing vehicles that offer better mileage and lower emissions. According to recent data, vehicles equipped with electric motors can enhance fuel efficiency by up to 30% compared to traditional internal combustion engines. This shift not only aligns with environmental regulations but also caters to consumer preferences for sustainable options. As a result, the integration of electric motors into IC engine vehicles is becoming a strategic imperative for automakers aiming to remain competitive in a rapidly evolving market.

Government Regulations and Incentives

Government regulations aimed at reducing carbon emissions are influencing the Electric Motors for IC Engine Vehicle Market. Many countries have implemented stringent emission standards, compelling manufacturers to adopt cleaner technologies. Additionally, various incentives, such as tax breaks and subsidies for electric vehicle production, are encouraging automakers to invest in electric motor technologies. For example, in several regions, manufacturers can receive substantial financial support for integrating electric motors into their vehicles, which can offset initial development costs. This regulatory environment not only fosters innovation but also accelerates the transition towards more sustainable automotive solutions.

Consumer Awareness and Environmental Concerns

Growing consumer awareness regarding environmental issues is significantly impacting the Electric Motors for IC Engine Vehicle Market. As individuals become more informed about the detrimental effects of fossil fuels, there is a marked shift towards vehicles that utilize electric motors. Surveys indicate that a considerable percentage of consumers are willing to pay a premium for vehicles that are environmentally friendly. This trend is prompting manufacturers to prioritize the development of electric motor technologies in their IC engine vehicles. The increasing demand for sustainable transportation options is likely to drive further investment in electric motor integration, shaping the future of the automotive industry.

Technological Advancements in Electric Motors

Technological innovations in electric motor design and manufacturing are propelling the Electric Motors for IC Engine Vehicle Market forward. Developments such as improved battery technologies, enhanced power-to-weight ratios, and advanced control systems are making electric motors more efficient and reliable. For instance, the introduction of permanent magnet synchronous motors has shown to increase efficiency levels significantly, often exceeding 90%. These advancements not only improve vehicle performance but also reduce production costs, making electric motors a more attractive option for manufacturers. Consequently, the ongoing evolution of technology is likely to play a crucial role in shaping the future landscape of the market.

Collaboration Between Automakers and Tech Companies

The collaboration between traditional automakers and technology firms is reshaping the Electric Motors for IC Engine Vehicle Market. Partnerships are emerging to leverage expertise in electric motor technology, software development, and data analytics. These collaborations aim to enhance vehicle performance and consumer experience through innovative solutions. For instance, automakers are increasingly working with tech companies to develop advanced driver-assistance systems that complement electric motor functionalities. This synergy not only accelerates the development of electric motors but also fosters a competitive edge in the market. As these partnerships continue to evolve, they are likely to drive significant advancements in the integration of electric motors into IC engine vehicles.