North America : Market Leader in Innovation

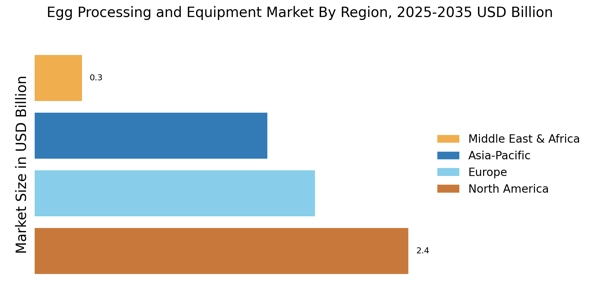

North America is the largest egg processing equipment market, holding approximately 40% of the global Egg Processing and Equipment Market share. The region benefits from advanced technology adoption, increasing consumer demand for processed egg products, and stringent food safety regulations. The growing trend towards automation in food processing is also a significant driver in the egg processing equipment market, enhancing efficiency and reducing labor costs.

The United States and Canada are the leading countries in egg processing equipment market, with major players like Hickman and EggTech based in the U.S. The competitive landscape is characterized by innovation and investment in R&D, with companies focusing on sustainable practices and product diversification. The presence of established firms ensures a robust supply chain and egg processing equipment market stability.

Europe : Regulatory Framework Drives Growth

Europe is the second-largest Egg Processing and Equipment Market accounting for around 30% of the global share. The region's growth is driven by increasing health consciousness among consumers, leading to higher demand for processed egg products. Additionally, EU regulations on food safety and quality standards are catalysts for egg processing equipment market expansion, pushing manufacturers to adopt advanced processing technologies.

Germany, the Netherlands, and France are the leading countries in egg processing equipment market sector, with key players like Bühler and Meyer operating extensively. The competitive landscape of the egg processing equipment market is marked by a focus on sustainability and innovation, with companies investing in eco-friendly technologies. The presence of strong regulatory bodies ensures compliance and fosters a competitive environment in egg processing equipment market.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is rapidly emerging as a significant player in the egg processing equipment market, holding approximately 25% of the global share. The region's growth is fueled by rising population, urbanization, and increasing disposable incomes, leading to higher consumption of processed egg products. Additionally, government initiatives to enhance food security and safety are propelling egg processing equipment market expansion.

Countries like China, Japan, and India are at the forefront of this growth, with key players such as Daiya and local manufacturers expanding their operations in the egg processing equipment market. The competitive landscape is evolving, with a mix of established companies and new entrants focusing on innovation and product development. The region's diverse consumer preferences also drive the demand for varied egg products.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is witnessing a gradual increase in the egg processing equipment market, currently holding about 5% of the global egg processing equipment market share. The growth is driven by rising population and urbanization, leading to increased demand for processed food products. Additionally, government initiatives aimed at improving food security and local production capabilities are significant catalysts for market development.

Countries like South Africa and the UAE are leading the way in this sector, with local and international players exploring opportunities in egg processing equipment market. The competitive landscape is characterized by a mix of established firms and new entrants, focusing on meeting the growing consumer demand for convenience and quality in egg products. Investment in modern processing technologies is also on the rise in the egg processing & equipment market.