Top Industry Leaders in the Drones for Oil Gas Market

On Sep. 29, 2023, DroneAcharya Aerial Innovations Limited (India) announced receiving a US$1.26 MN (Rs 10.5 crore) contract from a Qatar-based provider of comprehensive drone sales, service, and software development solutions to the country's oil and gas sector. This strategic collaboration will enable DroneAcharya to revolutionize operations in the O&G sector, harnessing the power of cutting-edge drone technology.

On Aug. 10, 2023, Epazz Inc. (EPAZ), a mission-critical drone technology provider, announced that ZenaDrone Inc. has secured funding to deploy 10 ZenaDrone 1000s for service in the oil & gas industry in Houston, Texas. The oil and gas industry has been looking for ways to replace heavy, expensive helicopters for delivery and inspections. The company has been talking with major oil companies about using its drones for inspections and delivery of machine parts to refineries and offshore oil grids.

On Jan. 24, 2023, Saudi Aramco, a leading global oil producer, announced $14 million in investments in Terra Drone, a Japanese drone and air mobility technology company, to help Saudi Arabia's long-term initiative to reduce the nation's dependence on hydrocarbons. Terra Drone will use the fund to create the subsidiary Terra Drone Arabia, which will provide oil-gas inspection services while accelerating the development of the Middle East's drone industry.

On Nov. 06, 2022, American Robotics announced a strategic partnership with Infrared Cameras Inc. for oil and gas inspection. American Robotics is focusing on the largest O&G companies to integrate autonomous drones into their system to conduct regular site inspections and ensure employee safety.

This strategic technology partnership will enable American Robotics to expand its product offerings for the oil and gas industry to automate inspections of critical assets such as tanks, pipes and pumps. Integrating American Robotics' autonomous Scout System drone with ICI's optical gas imaging (OGI) and thermal sensors will enable the necessary technology to automate the inspection of oil & gas assets and the detection of methane leaks.

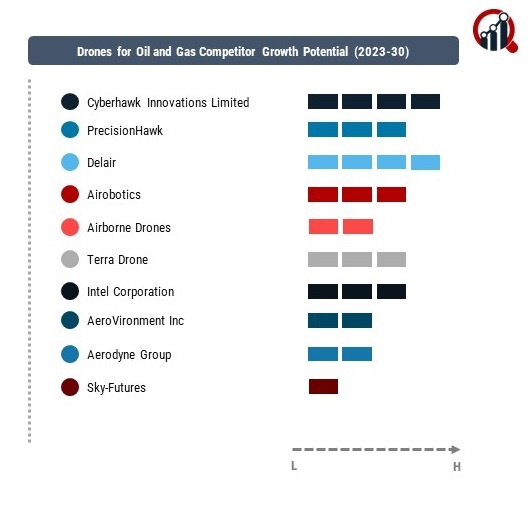

Key Companies in the Drones for Oil and Gas Industry include

- Cyberhawk Innovations Limited

- PrecisionHawk

- Delair

- Airobotics

- Airborne Drones

- Terra Drone

- Intel Corporation

- AeroVironment Inc

- Aerodyne Group

- Sky-Futures