Research Methodology on Drones for Oil Gas Market

Introduction

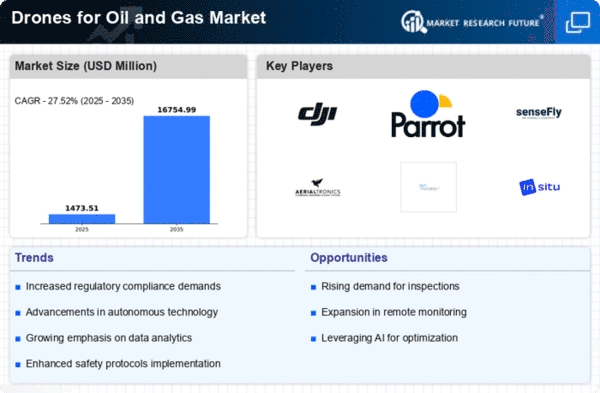

The increasing usage of drones in oil and gas industries is quite steadily increased in recent years owing to the advantages that this technology provides to the industry. Drones for the oil and gas industry are essential for multiple services such as asset inspections and surveillance, land elevation or surface mapping, assisting in emergency management, etc.

The overall drone market for oil and gas is expected to witness significant growth that is mainly attributed to the growing need for the surveillance and the management of oil and gas infrastructure in remote areas, the rising awareness of drone applications in the industry and the considerable increase in the adoption of Internet of Things (IoT) technology. The global drones for the oil and gas market are expected to witness considerable growth in the forecast period from 2023 to 2030.

The purpose of this research report is to gain insight into the global drones for the oil and gas market. This research provides a detailed research methodology encompassing the selection of the data sources, analysis methods, and research limitations.

Research Objectives

- To analyze and assess the global drones for the oil and gas market.

- To forecast the growth trends of the global drones for the oil and gas market.

- To identify the factors driving the global drones for the oil and gas market.

- To profile the leading companies operating in the global drones for the oil and gas market.

Research Scope

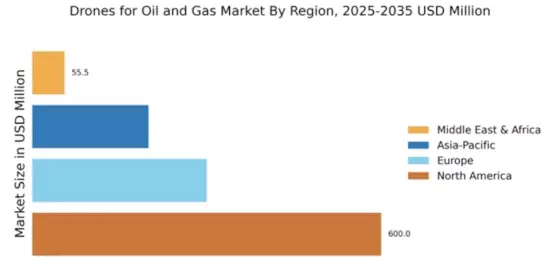

The global drones for the oil and gas market research in terms of vehicle type, solution type and applications. The research report also provides an extensive market analysis for regions such as North America, Europe, Asia-Pacific and the Rest of the World.

Research Methodology

This research report about the market for drones for oil and gas includes an in-depth study of market dynamics, segmentation, and an extensive regional outlook. A comprehensive market analysis is provided by profiting from exhaustive primary and secondary research, incorporating an interactive industry-based model.

The objective of this Research

The main objective of this research project is to gain an in-depth understanding of the global drones for the oil and gas market. This report provides an analysis of the current market landscape and trends to gain insight into the understanding of the market's future.

Data Sources

Primary sources

The primary data for this report includes an in-depth discussion with industry experts, company CEOs, and senior management personnel. This helps in obtaining insights into the growth prospects of global drones for the oil and gas market.

Secondary sources

Secondary data for this research include a thorough review of existing literature, industry market databases, financial data, and others. The secondary data in this report include, but are not limited to:

Industry research reports

Analysis reports

Data Analytics

Market trackers

White papers

Financial reports

Financial reports

Annual reports

Press releases

Research Assumptions

The assumptions made are based on the current trends in the global drones for the oil and gas market and are based on an approximate estimation of the factors that could affect the future growth of the market. These factors include:

- Rising demand from the oil and gas industry

- Government initiatives towards the adoption of renewable energy

- Increasing long-distance drilling activities

- Increasing use of the Internet of Things (IoT)

Conclusion

This research report provides a comprehensive research methodology for the global drones for the oil and gas market. The research approach includes the selection of data sources, assessment methods and research limitations. The present research provides an understanding of the market dynamics, metrics, trends, and the competitive landscape of the global market. This research will help in making informed decisions and aid in the development of effective strategies for global drones for the oil and gas market.