Market Trends

Key Emerging Trends in the Drones for Oil Gas Market

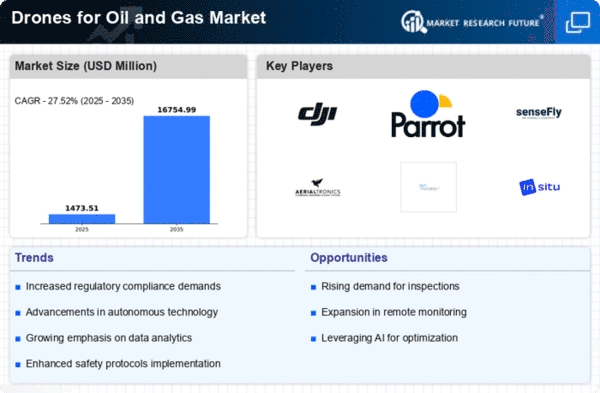

The Drones for Oil and Gas Market is experiencing transformative trends that are reshaping operations, enhancing safety, and optimizing efficiency within the energy sector.

One significant trend involves the increasing utilization of drones for inspection and monitoring purposes. Drones equipped with advanced sensors, cameras, LiDAR, and thermal imaging capabilities are revolutionizing the way oil and gas infrastructure is inspected. These unmanned aerial vehicles enable companies to conduct comprehensive aerial surveys of pipelines, rigs, storage tanks, and other critical assets. The high-resolution imaging and data collection capabilities of drones allow for more frequent and detailed inspections, facilitating proactive maintenance, identifying potential issues, and optimizing asset management.

Another prominent trend is the integration of drones for environmental monitoring and compliance. Oil and gas companies are deploying drones equipped with specialized sensors to detect gas leaks, monitor emissions, and assess environmental impact in remote or hazardous areas. These drones provide real-time data on air quality, vegetation health, and wildlife presence, enabling companies to mitigate environmental risks and ensure compliance with environmental regulations, contributing to sustainable and responsible operations.

Furthermore, the adoption of beyond-visual-line-of-sight (BVLOS) operations is gaining traction in the oil and gas sector. BVLOS capabilities allow drones to operate beyond the operator's visual range, covering larger areas and expanding their utility in monitoring extensive oil fields and remote infrastructure. Companies are exploring the development of autonomous drone fleets capable of conducting routine inspections, reducing human intervention, and increasing operational efficiency.

Data analytics and artificial intelligence (AI) are emerging trends shaping the use of drones in the oil and gas industry. The massive amounts of data collected by drones during inspections require advanced analytics to derive actionable insights. AI-powered algorithms process and analyze this data, identifying patterns, predicting maintenance needs, and optimizing operational decisions. Integrating AI-driven analytics enhances the efficiency of inspections, facilitates predictive maintenance, and enables data-driven decision-making for oil and gas companies.

Additionally, advancements in drone technology are facilitating the development of specialized drones tailored to meet the specific needs of the oil and gas sector. Companies are investing in drones with extended flight times, improved battery life, enhanced payload capacities, and rugged designs capable of operating in challenging environments. These specialized drones cater to the unique demands of the industry, such as inspecting offshore rigs, conducting surveys in harsh climates, and navigating complex terrain, improving operational capabilities.

However, challenges persist amidst these trends. Regulatory compliance remains a significant hurdle in fully integrating drones into oil and gas operations. Companies must navigate aviation regulations, airspace restrictions, and privacy laws to ensure compliance when deploying drones. Additionally, ensuring data security and privacy while managing the vast amounts of sensitive information collected by drones poses ongoing challenges for the industry.

In conclusion, the Drones for Oil and Gas Market is witnessing transformative trends driven by technological advancements, environmental monitoring needs, BVLOS operations, data analytics, AI integration, and specialized drone development. Adapting to these trends requires oil and gas companies to invest in cutting-edge drone technology, navigate regulatory complexities, and harness the potential of data analytics and AI. Successful integration of drones in oil and gas operations offers improved safety, enhanced efficiency, cost savings, and environmental stewardship, positioning drones as indispensable tools for the industry's future growth and sustainability.

Leave a Comment