Government Incentives and Support Programs

Government policies and incentives are crucial in propelling the Distribution Energy Generation Market forward. Many countries have implemented favorable regulations, tax credits, and subsidies to encourage the adoption of renewable energy technologies. For example, as of 2025, several nations are offering tax incentives that can cover up to 30% of the installation costs for solar energy systems. Such initiatives not only stimulate investment in renewable energy but also foster public-private partnerships that enhance infrastructure development. The presence of supportive regulatory frameworks appears to create a conducive environment for market growth, as they mitigate financial risks and encourage innovation in energy generation.

Rising Energy Costs and Economic Pressures

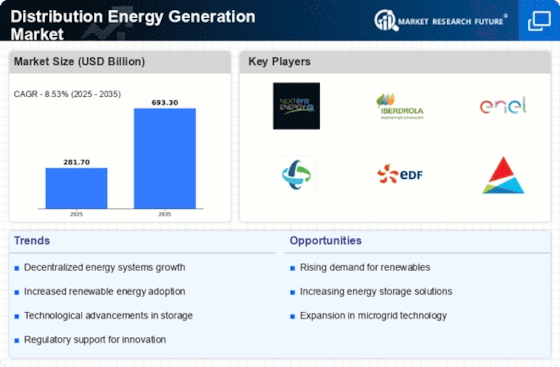

The Distribution Energy Generation Market is significantly influenced by rising energy costs and economic pressures. As traditional energy sources become more expensive due to fluctuating fossil fuel prices, consumers and businesses are increasingly seeking alternative energy solutions. The cost of electricity has risen by an average of 5% annually in many regions, prompting a shift towards more sustainable and cost-effective energy generation methods. This economic pressure is likely to drive investments in renewable energy technologies, as they offer long-term savings and energy security. Consequently, the market is expected to expand as stakeholders recognize the financial benefits of transitioning to distributed energy generation.

Technological Innovations in Energy Generation

Technological advancements are playing a pivotal role in shaping the Distribution Energy Generation Market. Innovations in solar photovoltaic systems, wind turbines, and biomass energy generation are enhancing efficiency and reducing costs. For instance, the efficiency of solar panels has improved significantly, with some models achieving over 22% efficiency as of 2025. Additionally, the integration of artificial intelligence and machine learning in energy management systems is optimizing energy production and consumption. These technologies not only lower operational costs but also improve the reliability of energy supply. As a result, the market is likely to witness an influx of new players and solutions, further driving competition and innovation within the industry.

Increasing Demand for Decentralized Energy Solutions

The Distribution Energy Generation Market is experiencing a notable shift towards decentralized energy solutions. This trend is driven by consumers' growing preference for energy independence and resilience against grid failures. As of 2025, approximately 30% of new energy installations are expected to be decentralized, reflecting a significant change in energy consumption patterns. The rise of smart technologies and microgrids facilitates this transition, allowing for localized energy production and consumption. Furthermore, the increasing awareness of environmental issues propels individuals and businesses to adopt renewable energy sources, thereby enhancing the market's growth. The demand for decentralized solutions appears to be a critical driver, as it aligns with broader sustainability goals and the need for reliable energy access.

Growing Environmental Awareness and Sustainability Goals

The Distribution Energy Generation Market is witnessing a surge in interest driven by heightened environmental awareness and sustainability goals. As climate change concerns escalate, both consumers and corporations are prioritizing sustainable practices. Reports indicate that over 70% of consumers are willing to pay a premium for renewable energy sources, reflecting a shift in purchasing behavior. This growing demand for clean energy solutions is prompting businesses to invest in renewable energy projects, thereby expanding the market. Furthermore, international agreements aimed at reducing carbon emissions are likely to bolster the adoption of distributed energy generation technologies, as stakeholders strive to meet their sustainability targets.