Rising Healthcare Expenditure

The Disposable Gloves Market is experiencing growth driven by increasing healthcare expenditure across various nations. Governments are allocating substantial budgets to healthcare, which enhances the demand for Industrial Hand Gloves in hospitals and clinics. For instance, in 2024, the market is projected to reach 28.1 USD Billion, reflecting the rising need for protective equipment. This trend is likely to continue as healthcare systems evolve and expand, necessitating the use of disposable gloves to ensure safety and hygiene. As healthcare expenditure rises, the Global Disposable Gloves Industry is poised for sustained growth.

Expansion of Food Safety Regulations

The Global Disposable Gloves Industry is influenced by the expansion of food safety regulations worldwide. Governments are implementing stringent regulations to ensure food safety, which necessitates the use of disposable gloves in food handling and preparation. This regulatory environment is likely to propel the market forward, as compliance with these regulations becomes mandatory for food businesses. The increasing focus on food safety, along with the growing use of Powdered disposable gloves, is expected to contribute to the projected compound annual growth rate of 6.8% from 2025 to 2035, further solidifying the role of disposable gloves in the Industrial Hand Gloves Industry.

Emerging Markets and Increased Demand

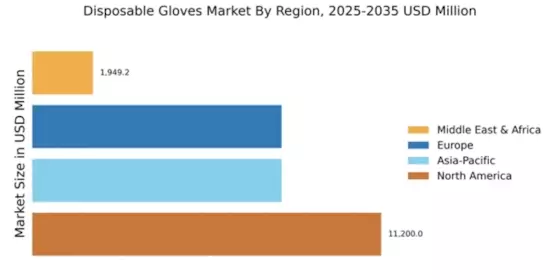

Emerging markets are contributing significantly to the growth of the Disposable Gloves Market. As economies develop, there is a rising demand for disposable gloves in healthcare, food service, and industrial applications. Countries in Asia-Pacific and Latin America are witnessing rapid urbanization and industrialization, which are likely to boost the consumption of disposable gloves. This trend is indicative of a broader global shift towards enhanced safety and hygiene standards. The increasing demand from these regions is expected to play a crucial role in the market's expansion, further solidifying its position in the Global Disposable Gloves Market Industry.

Growing Awareness of Hygiene Practices

There is a notable increase in awareness regarding hygiene practices among consumers and businesses, which significantly impacts the Disposable Gloves Industry. The emphasis on cleanliness and safety in various sectors, including food service and healthcare, drives the demand for disposable gloves. This heightened awareness is likely to lead to a projected market value of 58.0 USD Billion by 2035. As organizations prioritize hygiene protocols, the adoption of disposable gloves becomes essential, thereby fostering growth in the Global Disposable Gloves Market Industry.

Technological Advancements in Material Science

Technological advancements in material science are playing a pivotal role in shaping the Disposable Gloves Market. Innovations in glove materials, such as the development of more durable and flexible synthetic options, enhance user experience and safety. These advancements not only improve the performance of disposable gloves but also cater to diverse industry needs. As manufacturers invest in research and development, the market is likely to benefit from improved product offerings, which could lead to increased adoption rates across various sectors, thus driving growth in the Global Disposable Gloves Market Industry.