Market Growth Projections

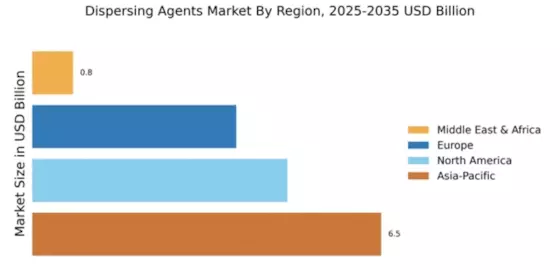

The Global Dispersing Agents Market Industry is poised for substantial growth, with projections indicating a market size of 5.45 USD Billion in 2024 and a potential increase to 14.2 USD Billion by 2035. This trajectory suggests a compound annual growth rate of 9.1% from 2025 to 2035, reflecting the increasing adoption of dispersing agents across various applications. The growth is driven by factors such as rising demand in the paints and coatings sector, technological advancements, and a focus on sustainable solutions. These projections highlight the dynamic nature of the market and the potential for innovation and expansion in the coming years.

Growth in the Construction Sector

The Global Dispersing Agents Market Industry is significantly influenced by the expansion of the construction sector. As urbanization accelerates globally, there is a heightened need for construction materials that incorporate dispersing agents to enhance performance and longevity. These agents are essential in producing concrete, mortars, and other building materials, ensuring optimal consistency and workability. The construction industry's growth is expected to contribute substantially to the market, with projections indicating a shift towards more sustainable and efficient building practices. This trend may further drive the demand for advanced dispersing agents that align with environmental regulations.

Rising Demand in Paints and Coatings

The Global Dispersing Agents Market Industry experiences a notable surge in demand driven by the expanding paints and coatings sector. As industries prioritize high-quality finishes and durability, dispersing agents play a crucial role in enhancing the stability and performance of these products. In 2024, the market is projected to reach 5.45 USD Billion, reflecting the increasing adoption of advanced formulations. Furthermore, the growth trajectory suggests that by 2035, the market could expand to 14.2 USD Billion, indicating a robust compound annual growth rate of 9.1% from 2025 to 2035. This trend underscores the essential function of dispersing agents in achieving optimal product characteristics.

Increasing Focus on Sustainable Solutions

Sustainability is becoming a central theme within the Global Dispersing Agents Market Industry, as manufacturers and consumers alike prioritize eco-friendly products. The growing awareness of environmental issues is prompting companies to seek dispersing agents derived from renewable resources or those that minimize environmental impact. This shift not only aligns with global sustainability goals but also caters to the preferences of environmentally conscious consumers. As a result, the market is likely to see a rise in the development and adoption of bio-based dispersing agents, which could reshape product offerings and drive growth in the coming years.

Technological Advancements in Manufacturing

Technological innovations within the Global Dispersing Agents Market Industry are pivotal in enhancing product efficacy and performance. The introduction of novel formulations and production techniques allows for the development of more efficient dispersing agents, which can significantly improve dispersion quality across various applications. For instance, advancements in nanotechnology are enabling the creation of dispersing agents that offer superior stability and compatibility with diverse materials. As manufacturers increasingly adopt these technologies, the market is likely to witness accelerated growth, driven by the demand for high-performance products that meet stringent industry standards.

Expanding Applications in Various Industries

The versatility of dispersing agents is a key driver in the Global Dispersing Agents Market Industry, as they find applications across multiple sectors, including pharmaceuticals, agriculture, and food processing. This broad applicability enhances market resilience, as demand from diverse industries can offset fluctuations in any single sector. For example, in pharmaceuticals, dispersing agents are crucial for formulating stable suspensions and emulsions, while in agriculture, they improve the efficacy of pesticides and fertilizers. The ongoing exploration of new applications is likely to sustain market growth, as industries continue to recognize the benefits of effective dispersion.