Technological Advancements

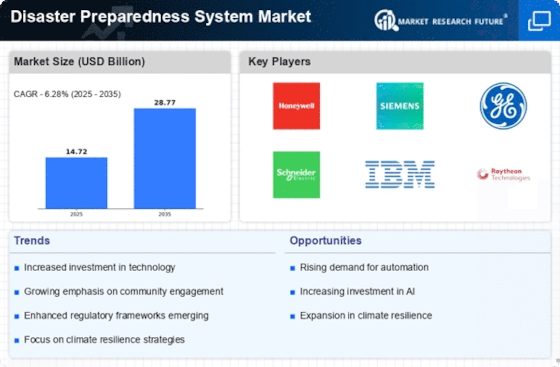

Technological advancements are revolutionizing the Disaster Preparedness System Market. Innovations such as artificial intelligence, machine learning, and big data analytics are enhancing predictive capabilities and response strategies. These technologies enable real-time data analysis, improving situational awareness during disasters. The integration of mobile applications and IoT devices allows for better communication and coordination among emergency responders. As organizations increasingly adopt these technologies, the market is projected to expand significantly, with estimates suggesting a growth rate of over 10% annually. This trend indicates a shift towards more sophisticated and efficient disaster preparedness solutions.

Public Awareness and Education

Public awareness and education regarding disaster preparedness are crucial drivers in the Disaster Preparedness System Market. As communities become more informed about the risks associated with natural disasters, there is a growing demand for educational programs and resources. Initiatives aimed at teaching individuals and families how to prepare for emergencies are gaining traction. This increased awareness not only fosters community resilience but also drives the market for disaster preparedness systems. Organizations that provide training and resources are likely to see a surge in demand, as communities seek to enhance their preparedness levels.

Government Regulations and Funding

Government regulations play a pivotal role in shaping the Disaster Preparedness System Market. Many countries have implemented stringent policies mandating disaster preparedness and response plans. This regulatory environment often comes with increased funding for local and national agencies to develop and maintain effective systems. For instance, recent legislation has allocated billions in disaster relief and preparedness funding, which directly impacts the market. As governments prioritize public safety, the demand for advanced disaster preparedness systems is likely to grow, fostering a competitive landscape where innovation and efficiency are paramount.

Increased Frequency of Natural Disasters

The Disaster Preparedness System Market is experiencing heightened demand due to the increasing frequency of natural disasters. Climate change has led to more severe weather patterns, resulting in floods, hurricanes, and wildfires. According to recent data, the number of natural disasters has surged by over 30% in the last decade. This alarming trend compels governments and organizations to invest in robust disaster preparedness systems to mitigate risks and enhance response capabilities. The urgency to protect lives and property drives innovation and investment in this sector, as stakeholders seek to develop comprehensive solutions that can effectively address the challenges posed by these unpredictable events.

Urbanization and Infrastructure Development

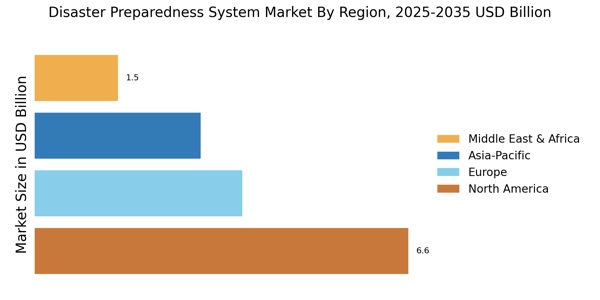

Urbanization and infrastructure development significantly influence the Disaster Preparedness System Market. As populations migrate to urban areas, the risk of disasters increases due to higher population density and vulnerable infrastructure. Cities are often ill-prepared for large-scale emergencies, prompting a need for comprehensive disaster preparedness systems. Recent studies indicate that urban areas are at a higher risk of experiencing catastrophic events, which necessitates the implementation of effective preparedness strategies. Consequently, investments in disaster preparedness systems are likely to rise, as urban planners and policymakers recognize the importance of safeguarding communities against potential threats.