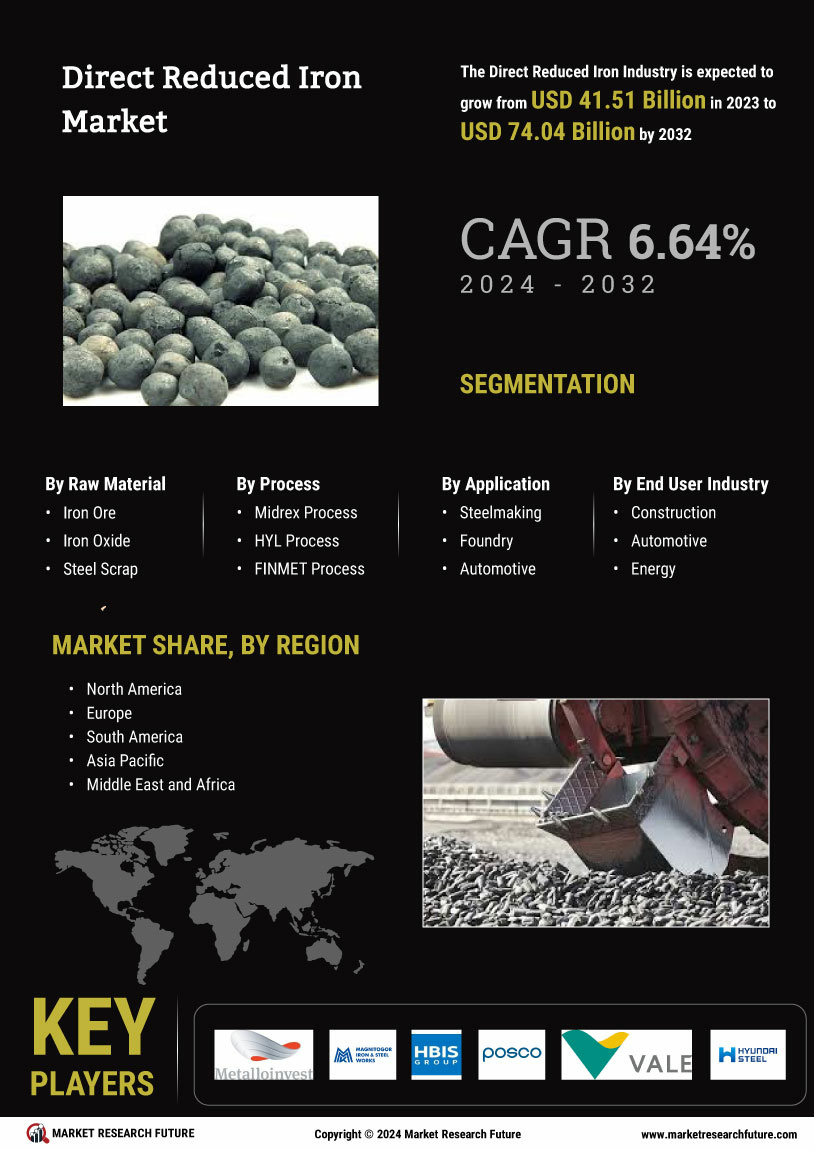

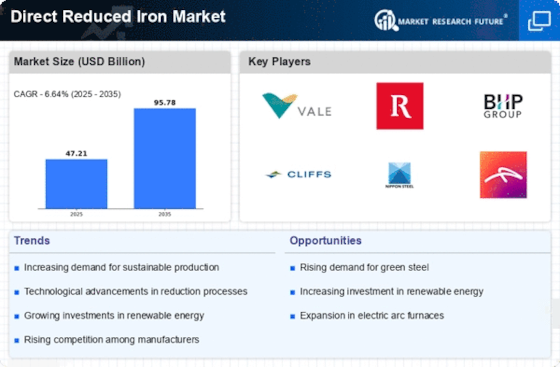

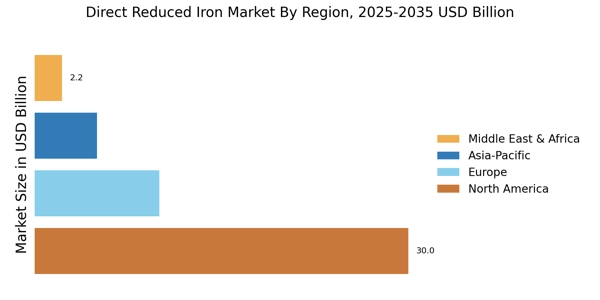

Rising Steel Demand

The resurgence in steel demand is a primary driver for the Direct Reduced Iron Market. As economies recover and infrastructure projects gain momentum, the need for high-quality steel is increasing. Direct reduced iron serves as a vital feedstock for electric arc furnaces, which are becoming the preferred choice for steel production due to their lower energy consumption and reduced emissions. According to recent data, the demand for steel is projected to grow by approximately 3% annually over the next few years, further bolstering the Direct Reduced Iron Market. This trend indicates a robust market environment where producers are likely to expand their capacities to meet the rising demand, thereby enhancing the overall growth prospects of the industry.

Technological Innovations

Technological advancements are reshaping the Direct Reduced Iron Market, enhancing production efficiency and product quality. Innovations such as the use of hydrogen as a reducing agent are emerging, potentially revolutionizing the way iron is produced. This method not only reduces carbon emissions but also aligns with global energy transition goals. Additionally, advancements in automation and digitalization are streamlining operations, reducing costs, and improving safety standards. The integration of smart technologies allows for real-time monitoring and optimization of production processes, which can lead to higher yields and lower waste. As these technologies continue to evolve, they are expected to play a pivotal role in the future of the Direct Reduced Iron Market, making it more competitive and sustainable.

Sustainability Initiatives

The increasing emphasis on sustainability within the Direct Reduced Iron Market is driving demand for environmentally friendly production methods. As industries strive to reduce their carbon footprints, the adoption of direct reduction processes, which typically emit fewer greenhouse gases compared to traditional methods, is gaining traction. This shift is evidenced by the rise in investments in renewable energy sources for iron production. Furthermore, regulatory frameworks are becoming more stringent, compelling manufacturers to adopt cleaner technologies. The Direct Reduced Iron Market is thus witnessing a transformation, where sustainability is not merely a trend but a fundamental aspect of operational strategies. Companies that prioritize sustainable practices are likely to gain a competitive edge, as consumers and stakeholders increasingly favor environmentally responsible products.

Shift in Raw Material Preferences

The Direct Reduced Iron Market is experiencing a notable shift in raw material preferences, driven by the need for higher quality inputs in steel production. As steelmakers seek to improve the properties of their products, there is a growing inclination towards using direct reduced iron, which offers superior metallurgical characteristics compared to traditional iron sources. This trend is particularly evident in regions where steel production is increasingly focused on high-grade applications. Furthermore, the volatility in the prices of traditional iron ore has prompted manufacturers to explore alternative sources, including direct reduced iron, which can provide more stable pricing. This shift not only supports the growth of the Direct Reduced Iron Market but also encourages innovation in sourcing and production techniques.

Regulatory Compliance and Standards

The evolving landscape of regulatory compliance is significantly influencing the Direct Reduced Iron Market. Governments worldwide are implementing stricter environmental regulations aimed at reducing industrial emissions. These regulations compel manufacturers to adopt cleaner production technologies, including direct reduction methods that align with compliance requirements. As a result, companies that fail to adapt may face penalties or lose market access. The Direct Reduced Iron Market is thus positioned to benefit from this regulatory shift, as it offers a viable solution for steelmakers looking to meet stringent standards. Moreover, adherence to these regulations can enhance a company's reputation and marketability, making compliance not just a legal obligation but a strategic advantage in a competitive marketplace.