North America : Stable Growth Environment

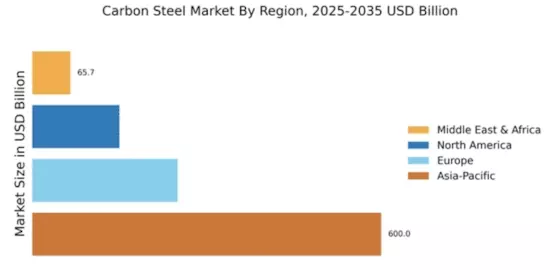

The North American carbon steel market is projected to grow steadily, driven by infrastructure development and automotive manufacturing. With a market size of $150.0 million, the region is witnessing increased demand for high-strength steel products. Regulatory support for sustainable practices is also a key driver, as companies aim to reduce carbon footprints and comply with environmental standards. Leading the market are the United States and Canada, where major players like United States Steel Corporation and ArcelorMittal are prominent. The competitive landscape is characterized by innovation in production techniques and a focus on quality. As the region emphasizes modernization, investments in technology and sustainable practices are expected to enhance market dynamics.

Europe : Innovation and Sustainability Focus

Europe's carbon steel market, valued at $250.0 million, is characterized by a strong emphasis on innovation and sustainability. The region is witnessing a shift towards eco-friendly production methods, driven by stringent regulations and consumer demand for greener products. This focus on sustainability is expected to propel growth, as companies adapt to new environmental standards and invest in cleaner technologies. Germany, France, and Italy are leading countries in this market, with key players like Thyssenkrupp AG and ArcelorMittal driving competition. The European market is also seeing collaborations between manufacturers and technology firms to enhance production efficiency. As the region aims for carbon neutrality, the carbon steel sector is poised for transformation, aligning with broader EU goals for sustainability.

Asia-Pacific : Dominant Market Leader

The Asia-Pacific region dominates the carbon steel market with a substantial share, valued at $600.0 million. This growth is fueled by rapid industrialization, urbanization, and increasing demand from sectors such as construction and automotive. Countries like China and India are leading the charge, supported by government initiatives aimed at boosting infrastructure development and manufacturing capabilities. Regulatory frameworks are also evolving to promote sustainable practices in steel production. China Baowu Steel Group and Nippon Steel Corporation are among the key players in this competitive landscape. The region's market is characterized by a mix of large-scale manufacturers and emerging companies, all vying for market share. As demand continues to rise, innovations in production processes and materials are expected to play a crucial role in shaping the future of the carbon steel market in Asia-Pacific.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa carbon steel market, valued at $65.67 million, is on the rise, driven by increasing construction activities and infrastructure projects. The region is witnessing a growing demand for carbon steel, particularly in the construction and energy sectors. Government initiatives aimed at enhancing industrial capabilities and attracting foreign investments are also contributing to market growth. Leading countries in this region include South Africa and the UAE, where companies like Steel Authority of India Limited are making significant inroads. The competitive landscape is evolving, with both local and international players striving to capture market share. As the region continues to develop, the carbon steel market is expected to expand, supported by ongoing investments in infrastructure and industrial projects.