Rising Demand in Automotive Sector

The Dimethyl Carbonate Market is experiencing a notable surge in demand from the automotive sector. DMC is increasingly utilized as a solvent and a fuel additive, enhancing the performance and efficiency of vehicles. The automotive industry is projected to grow at a compound annual growth rate of approximately 4% over the next few years, which could further drive the demand for DMC. As manufacturers seek to improve fuel efficiency and reduce emissions, the adoption of DMC in various automotive applications appears to be a strategic move. This trend indicates a potential for increased production and consumption of DMC, thereby positively impacting the overall market dynamics.

Growth in Electronics Manufacturing

The electronics manufacturing sector is a significant driver for the Dimethyl Carbonate Market. DMC is employed as a solvent in the production of electronic components, particularly in the formulation of electrolytes for lithium-ion batteries. With the increasing reliance on electronic devices and the anticipated growth of the battery market, which is expected to reach USD 120 billion by 2026, the demand for DMC is likely to rise. This growth in electronics manufacturing not only supports the DMC market but also encourages innovation in production processes, thereby enhancing the overall efficiency and sustainability of the industry.

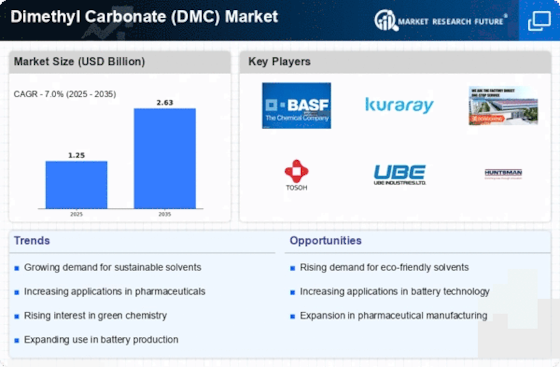

Increasing Adoption in Green Chemistry

The Dimethyl Carbonate Market is benefiting from the increasing adoption of green chemistry principles across various sectors. DMC is recognized for its environmentally friendly properties, serving as a non-toxic alternative to traditional solvents. As industries strive to reduce their environmental footprint, the demand for sustainable chemical solutions is on the rise. The Dimethyl Carbonate Market (DMC) is expected to reach USD 100 billion by 2025, indicating a strong trend towards eco-friendly practices. This shift towards sustainability is likely to enhance the appeal of DMC, positioning it as a preferred choice for companies aiming to comply with stringent environmental regulations and consumer preferences.

Expansion of Pharmaceutical Applications

The pharmaceutical industry is increasingly recognizing the utility of Dimethyl Carbonate Market (DMC) in various applications, which serves as a key driver for the DMC Market. DMC is utilized as a solvent in drug formulation and synthesis, offering advantages such as low toxicity and high efficiency. The pharmaceutical market is projected to grow significantly, with estimates suggesting a value of over USD 1.5 trillion by 2023. This expansion is likely to bolster the demand for DMC, as pharmaceutical companies seek safer and more effective solvents for their processes. The integration of DMC into pharmaceutical applications may also lead to advancements in drug delivery systems, further enhancing its market potential.

Technological Advancements in Production Processes

Technological advancements in the production processes of Dimethyl Carbonate Market (DMC) are emerging as a crucial driver for the DMC Market. Innovations in manufacturing techniques, such as the development of more efficient catalytic processes, are enabling the production of DMC at lower costs and with reduced environmental impact. These advancements not only enhance the economic viability of DMC production but also align with the growing demand for sustainable chemical solutions. As production becomes more efficient, the market is likely to witness an increase in supply, which could further stimulate demand across various applications, including automotive, electronics, and pharmaceuticals.