Market Trends and Projections

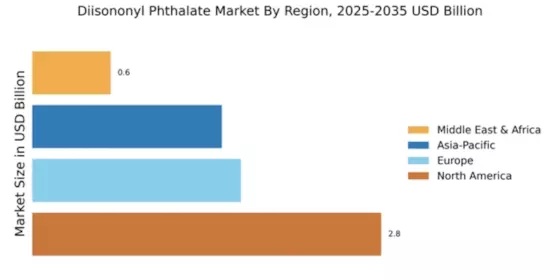

The Global Diisononyl Phthalate Market Industry is characterized by dynamic trends and projections that highlight its growth potential. In 2024, the market is anticipated to reach 5.02 USD Billion, with a projected compound annual growth rate of 9.28% from 2025 to 2035. This growth trajectory reflects the increasing adoption of Diisononyl Phthalate Market across various applications, including automotive, construction, and consumer goods. As industries continue to evolve and adapt to changing regulations and consumer preferences, the market is likely to expand significantly, potentially reaching 13.3 USD Billion by 2035.

Expansion in Construction Activities

The Global Diisononyl Phthalate Market Industry is significantly influenced by the expansion of construction activities across various regions. As urbanization accelerates, the demand for construction materials that incorporate Diisononyl Phthalate Market as a plasticizer is likely to increase. This trend is particularly evident in emerging economies where infrastructure development is a priority. The versatility of Diisononyl Phthalate Market in enhancing the performance of construction materials positions it as a key ingredient in the industry. Consequently, the market is poised for growth, potentially reaching 13.3 USD Billion by 2035, driven by the ongoing construction boom.

Growing Demand from Automotive Sector

The Global Diisononyl Phthalate Market Industry experiences a notable surge in demand driven by the automotive sector. As manufacturers increasingly prioritize flexible and durable materials for vehicle interiors, the use of Diisononyl Phthalate Market in plasticizers becomes essential. This trend aligns with the industry's shift towards lightweight materials to enhance fuel efficiency. In 2024, the market is projected to reach 5.02 USD Billion, with expectations of significant growth as the automotive sector continues to expand. The anticipated compound annual growth rate of 9.28% from 2025 to 2035 further underscores the potential of this market segment.

Technological Advancements in Production

The Global Diisononyl Phthalate Market Industry is poised for growth due to technological advancements in production processes. Innovations that enhance the efficiency and sustainability of Diisononyl Phthalate Market manufacturing are likely to attract investment and increase production capacity. These advancements may lead to reduced costs and improved product quality, making Diisononyl Phthalate Market more appealing to manufacturers across various sectors. As a result, the market could experience a robust growth trajectory, with projections indicating a rise to 13.3 USD Billion by 2035, reflecting the positive impact of these technological developments.

Rising Awareness of Health and Safety Standards

The Global Diisononyl Phthalate Market Industry is increasingly shaped by rising awareness of health and safety standards among consumers and manufacturers. As stakeholders become more informed about the potential risks associated with certain chemicals, there is a growing preference for safer alternatives. Diisononyl Phthalate Market, recognized for its relatively lower toxicity compared to other phthalates, may benefit from this shift in consumer perception. This trend is likely to drive demand, contributing to the market's growth, which is expected to reach 5.02 USD Billion in 2024 and continue expanding towards 13.3 USD Billion by 2035.

Regulatory Support for Eco-Friendly Alternatives

The Global Diisononyl Phthalate Market Industry benefits from regulatory frameworks that encourage the use of safer, eco-friendly alternatives. Governments worldwide are increasingly implementing regulations aimed at reducing harmful substances in consumer products, which may lead to a shift towards Diisononyl Phthalate Market as a preferred plasticizer. This regulatory support is crucial as it not only enhances product safety but also aligns with global sustainability goals. As a result, manufacturers are likely to invest in Diisononyl Phthalate Market, anticipating a market growth trajectory that could see the industry reach 13.3 USD Billion by 2035.