Increased Urbanization

Urbanization plays a pivotal role in shaping the Global Digital Ooh Market Industry. As populations migrate to urban areas, the demand for advertising space in high-traffic locations intensifies. This trend is particularly evident in metropolitan regions where digital billboards and screens are strategically placed to capture the attention of commuters and pedestrians. The increasing density of urban populations creates a fertile ground for advertisers, leading to a projected market growth to 31.8 USD Billion by 2035. This urban-centric advertising approach not only maximizes visibility but also enhances the relevance of advertisements, aligning them with the lifestyles of urban dwellers.

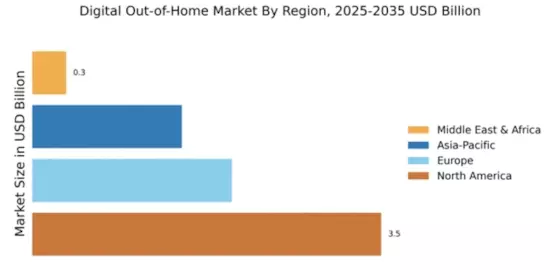

Market Growth Projections

The Global Digital Ooh Market Industry is on a trajectory of significant growth, with projections indicating a market size of 7.34 USD Billion in 2024. This growth is expected to accelerate, reaching an estimated 31.8 USD Billion by 2035, reflecting a compound annual growth rate of 14.27% from 2025 to 2035. Such figures underscore the increasing adoption of digital advertising formats across various sectors, including retail, transportation, and entertainment. The market's expansion is indicative of a broader shift towards digital solutions in advertising, as businesses seek to leverage the advantages of real-time data and targeted messaging to enhance consumer engagement.

Technological Advancements

The Global Digital Ooh Market Industry experiences robust growth driven by rapid technological advancements. Innovations in display technology, such as high-definition screens and interactive displays, enhance the effectiveness of digital out-of-home advertising. These advancements allow for dynamic content delivery and real-time updates, which are appealing to advertisers seeking to engage consumers more effectively. As a result, the market is projected to reach 7.34 USD Billion in 2024, reflecting a growing preference for digital formats over traditional advertising. The integration of artificial intelligence and data analytics further optimizes ad placements, ensuring that messages reach targeted audiences efficiently.

Consumer Engagement Strategies

The Global Digital Ooh Market Industry is significantly influenced by evolving consumer engagement strategies. Advertisers are increasingly leveraging digital out-of-home platforms to create immersive experiences that resonate with audiences. Interactive campaigns, such as augmented reality and gamification, are becoming commonplace, allowing brands to foster deeper connections with consumers. This shift towards experiential marketing is expected to contribute to a compound annual growth rate of 14.27% from 2025 to 2035. By utilizing digital screens to deliver personalized content, brands can enhance customer engagement, thereby driving higher conversion rates and improving overall advertising effectiveness.

Integration with Digital Ecosystems

The integration of digital out-of-home advertising with broader digital ecosystems is a key driver of the Global Digital Ooh Market Industry. As advertisers seek to create cohesive marketing strategies, the synergy between digital OOH and online platforms becomes increasingly important. This integration allows for cross-channel campaigns that reinforce brand messaging across various touchpoints. For instance, digital billboards can be synchronized with social media campaigns, amplifying reach and engagement. This trend is likely to propel the market forward, as brands recognize the value of a unified approach to digital advertising, enhancing their overall marketing effectiveness.

Regulatory Support and Infrastructure Development

Regulatory support and infrastructure development are crucial factors influencing the Global Digital Ooh Market Industry. Governments worldwide are increasingly recognizing the economic benefits of digital advertising and are implementing policies that facilitate its growth. This includes streamlined permitting processes for digital signage and investments in urban infrastructure that support the installation of digital displays. Such initiatives not only enhance the visibility of advertisements but also contribute to the overall aesthetic of urban environments. As a result, the market is poised for substantial growth, with projections indicating a rise to 31.8 USD Billion by 2035, driven by favorable regulatory frameworks.